When you take a loan, you don’t just repay the money you borrowed. You also pay interest, which is the cost of borrowing money. Many people focus only on the interest rate but forget something even more important — how the interest is calculated.

There are two main ways interest is calculated on loans:

- Simple Interest

- Compound Interest

Understanding the difference between simple vs compound interest on loans can save you hundreds or even thousands of dollars over time. This blog explains everything in easy language, with clear examples and dollar calculations, so you can make smart financial decisions.

What Is Interest on a Loan?

Interest is the extra money a lender charges you for using their money. It is usually shown as a percentage per year.

For example:

- If you borrow $10,000 at 8% interest, you pay interest every year until the loan is fully repaid.

But here is the key question:

👉 Is the interest charged only on the original amount or also on previous interest?

That answer decides whether your loan uses simple interest or compound interest.

What Is Simple Interest?

Meaning of Simple Interest

Simple interest is calculated only on the original loan amount, also called the principal.

It does not increase over time based on previously added interest.

This makes simple interest:

- Easy to understand

- Easy to calculate

- Often cheaper for borrowers

Simple Interest Formula

Simple Interest=P×R×T

Where:

- P = Principal (loan amount)

- R = Annual interest rate (in decimal)

- T = Time in years

Simple Interest Example (in Dollars)

Let’s say:

- Loan amount = $10,000

- Interest rate = 6% per year

- Loan term = 5 years

Calculation:

10,000×0.06×5=3,000

Total interest paid = $3,000

Total amount repaid = $13,000

Here, the interest remains the same every year.

Key Features of Simple Interest Loans

- Interest is calculated only on the principal

- Total interest is predictable

- Paying early reduces interest cost

- Easier to manage for borrowers

What Is Compound Interest?

Meaning of Compound Interest

Compound interest is calculated on:

- The original loan amount plus

- Any interest already added

This means you are paying interest on interest, which increases the total loan cost over time.

Compound interest grows faster than simple interest, especially for long-term loans.

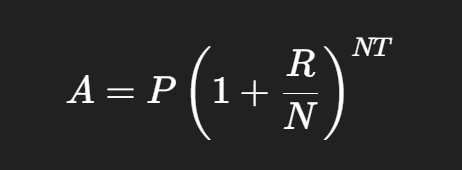

Compound Interest Formula

Where:

- A = Total amount after interest

- P = Principal

- R = Annual interest rate

- N = Number of times interest is compounded per year

- T = Time in years

Interest paid = A − P

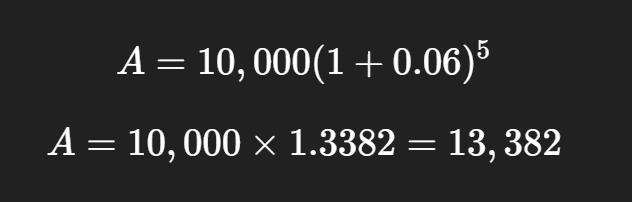

Compound Interest Example (in Dollars)

Let’s take the same loan:

- Loan amount = $10,000

- Interest rate = 6%

- Loan term = 5 years

- Compounding = Once per year

Calculation:

Interest paid = $3,382

Total repayment = $13,382

👉 Compared to simple interest, you paid $382 more due to compounding.

Effect of More Frequent Compounding

If interest is compounded monthly, the cost increases even more.

For example:

- Same loan

- Monthly compounding (12 times per year)

The total repayment becomes higher than $13,382 because interest is added more frequently.

Simple vs Compound Interest on Loans: Side-by-Side Comparison

| Feature | Simple Interest | Compound Interest |

| Interest calculation | Only on principal | On principal + interest |

| Growth pattern | Linear | Exponential |

| Total cost | Lower | Higher |

| Complexity | Easy | More complex |

| Best for borrowers | Short-term loans | Usually not ideal |

| Common usage | Personal loans, auto loans | Credit cards, some private loans |

Which Is Better for Borrowers?

Simple Interest: Better for Most Borrowers

Simple interest loans are generally better for borrowers because:

- You pay less total interest

- Extra payments reduce principal directly

- Loan cost stays transparent

Compound Interest: Risky for Long-Term Debt

Compound interest can be expensive because:

- Interest keeps adding up

- Long loan terms increase cost sharply

- Missed payments increase debt faster

This is why compound interest is great for savings but dangerous for loans.

Loan Types and Interest Methods

Loans That Commonly Use Simple Interest

- Personal loans

- Auto loans

- Student loans (many types)

- Mortgages (interest calculated daily but applied simply)

Loans That Often Use Compound Interest

- Credit cards

- Payday loans

- Some private or short-term loans

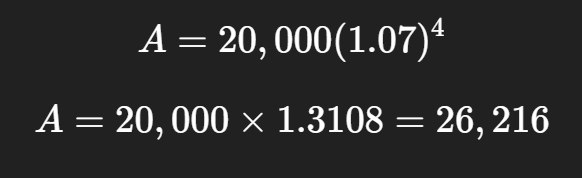

Real-Life Loan Comparison Example

Scenario 1: Simple Interest Loan

- Loan amount: $20,000

- Interest rate: 7%

- Term: 4 years

20,000×0.07×4=5,600

Total repayment = $25,600

Scenario 2: Compound Interest Loan (Annual)

Total repayment = $26,216

👉 Compound interest costs $616 more in just 4 years.

How Loan Payments Affect Interest

Early Payments Save Money

- In simple interest loans, early payments reduce interest immediately

- In compound interest loans, early payments help stop interest-on-interest growth

Missed Payments Increase Cost

- Missed payments increase principal

- More interest is calculated on a higher balance

- Compound interest loans grow faster after missed payments

APR vs Interest Rate: Important to Understand

- Interest rate shows how interest is calculated

- APR (Annual Percentage Rate) includes:

- Interest

- Fees

- Other loan costs

APR helps you compare loans more accurately, especially when fees differ.

How to Choose the Right Loan

Before taking any loan, always ask:

- Is the interest simple or compound?

- How often is interest calculated?

- What is the total repayment amount?

- Can I make extra payments without penalty?

- What is the APR?

Tips to Reduce Interest on Loans

- Choose simple interest loans when possible

- Pay more than the minimum payment

- Avoid long loan terms

- Refinance if interest rates drop

- Avoid loans with frequent compounding

Why Understanding Interest Matters

Many borrowers focus only on monthly payments. But:

- Lower monthly payments can mean higher total interest

- Compound interest can quietly increase debt

- Understanding calculations helps avoid financial stress

Knowing the difference between simple vs compound interest on loans helps you borrow smarter and repay faster.

Common Mistakes Borrowers Make

- Ignoring how interest is calculated

- Choosing long-term loans without checking total cost

- Making minimum payments on compound interest loans

- Not comparing APRs

Avoiding these mistakes can save you a lot of money.

Also Read: How Do Loan Terms Affect the Cost of Credit?

Final Thoughts: Simple vs Compound Interest on Loans

Simple and compound interest may sound similar, but their impact on your loan is very different.

- Simple interest loans are easier, clearer, and usually cheaper.

- Compound interest loans grow faster and cost more over time.

- For borrowing, simple interest is usually the better choice.

- Always read loan terms and calculate total repayment before signing.

By understanding how interest works, you protect your money and make better financial decisions.