Running a business often requires buying costly equipment — whether it’s a delivery van, manufacturing machine, medical device, or computer system. But what if your business doesn’t have the cash to pay for it upfront?

That’s where equipment financing becomes a smart choice. It helps businesses in Australia purchase or lease equipment without draining their working capital.

In this blog, we’ll explain everything about equipment financing for business in simple terms, with examples, calculations, benefits, and practical tips.

💡 What Is Equipment Financing for Business?

Equipment financing is a loan or lease used to buy business equipment. You don’t pay the full amount at once — instead, you pay small regular amounts over time while using the equipment to generate income.

For example, if your café needs a new coffee machine worth AUD 20,000, you can get an equipment loan or lease it. You pay monthly instalments instead of paying AUD 20,000 upfront.

When you choose equipment financing, the equipment itself is usually used as collateral. This means the lender can take back the equipment if you can’t repay the loan.

⚙️ What Equipment Can Be Financed?

In Australia, both small and large businesses use equipment financing for almost any asset that helps in daily operations.

Some common examples include:

- Commercial vehicles (vans, trucks, utes)

- Machinery for construction or manufacturing

- Office computers and IT equipment

- Medical and dental equipment

- Farming and agricultural tools

- Kitchen or café appliances

- Printing and packaging machines

So, whether you run a café in Sydney or a farm in Queensland, equipment finance can help you get the tools you need without blocking your cash flow.

🏦 Types of Equipment Financing in Australia

Businesses generally choose between two main types:

| Type | What It Means | Who Owns the Equipment | Typical Use |

| Equipment Loan (Chattel Mortgage) | Borrow money to buy the equipment outright | You (after loan repayment) | Long-term ownership |

| Equipment Lease | Rent or hire the equipment for a fixed period | The lender or lessor | Short-term or tech assets |

Let’s understand both in detail.

1️⃣ Equipment Loan (Chattel Mortgage)

An equipment loan (often called a chattel mortgage in Australia) means the lender provides funds to purchase equipment. You take ownership immediately, but the lender holds a “mortgage” over it until you finish paying off the loan.

Example:

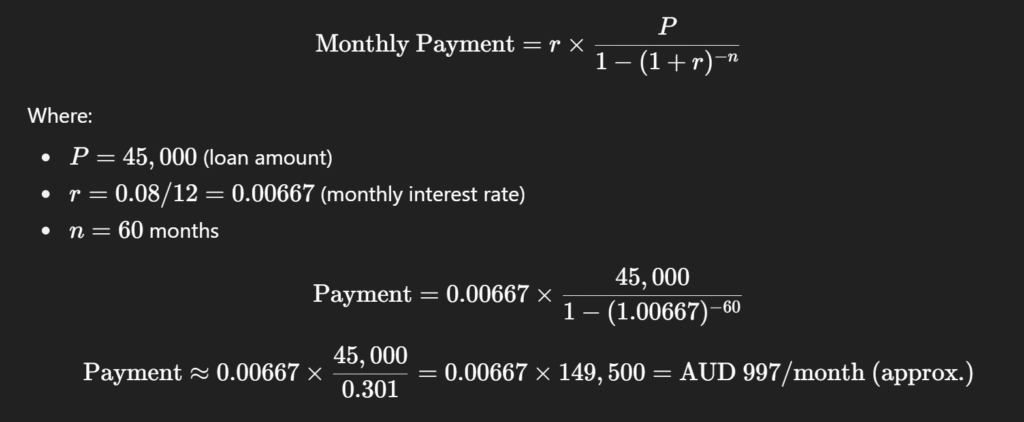

Let’s say your landscaping business wants to buy a new tractor for AUD 50,000. You pay a 10% deposit (AUD 5,000) and borrow AUD 45,000 from the lender at 8% annual interest for 5 years.

To calculate the monthly repayment, we use this formula:

Total payments: AUD 997 × 60 = AUD 59,820

Total interest paid: AUD 59,820 – AUD 45,000 = AUD 14,820

You own the tractor once the loan ends.

✅ Best for:

- Businesses wanting long-term ownership

- Assets with long life (trucks, heavy machinery, etc.)

2️⃣ Equipment Lease

An equipment lease means you rent the equipment for a certain period. The lender (lessor) owns the asset, and you make monthly payments to use it.

At the end of the lease, you may:

- Return the equipment, or

- Pay a residual amount to buy it, or

- Extend the lease for another term.

Example:

If you lease that same AUD 50,000 tractor for 5 years at 8% interest, and the lessor keeps a 10% residual (AUD 5,000), the finance amount becomes AUD 45,000 (same as above).

Your lease payment ≈ AUD 997/month, and at the end, you can pay AUD 5,000 to buy it.

So, total cost = (997 × 60) + 5,000 = AUD 64,820.

The lease costs a bit more, but it gives flexibility — you can upgrade, change equipment, or avoid maintenance headaches.

✅ Best for:

- Businesses needing flexibility

- Equipment that gets outdated quickly (like IT gear, medical tech, or electronics)

💰 Why Choose Equipment Financing?

Here are the top benefits of equipment financing for Australian businesses:

- Preserves Cash Flow:

You don’t have to pay the full price upfront. Regular small payments keep your business cash flow healthy. - Own or Upgrade Easily:

With a loan, you own the asset after repayment. With a lease, you can upgrade anytime. - Tax Benefits:

- Under Australian tax rules, you may claim depreciation and interest costs as deductions.

- Lease payments may also be tax-deductible.

(Always confirm with your accountant or the Australian Taxation Office (ATO).)

- Under Australian tax rules, you may claim depreciation and interest costs as deductions.

- Fixed Payments Help in Budgeting:

Regular instalments make future expenses predictable. - Easier Approval:

Since the equipment itself acts as collateral, lenders approve faster than unsecured loans. - No Additional Collateral Needed:

You don’t have to mortgage your home or business property. - Improves Productivity:

You can access high-quality, modern tools and boost efficiency quickly.

📊 Equipment Finance Calculations (Australian Example)

Let’s compare loan vs. lease side-by-side for a real example.

| Details | Equipment Loan | Equipment Lease |

| Equipment Cost | AUD 50,000 | AUD 50,000 |

| Interest Rate | 8% p.a. | 8% p.a. |

| Term | 5 years | 5 years |

| Deposit | 10% (AUD 5,000) | None |

| Residual Value | None | AUD 5,000 |

| Monthly Payment | AUD 997 | AUD 997 |

| Total Paid | AUD 59,820 | AUD 64,820 |

| Ownership | Yours after term | Optional (pay residual) |

| Flexibility | Low | High |

✅ Conclusion:

The loan option costs less in total, but the lease offers flexibility if you need frequent upgrades.

📄 Eligibility and Documents Required

Australian lenders usually ask for:

- Australian Business Number (ABN)

- Business Activity Statements (BAS)

- Financial statements or cash flow reports

- Proof of identity (drivers licence, passport)

- Equipment quotation or invoice

- Credit history or bank statements

🏢 Who Offers Equipment Financing in Australia?

Many banks and finance companies offer equipment loans and leases, including:

- Commonwealth Bank (CBA)

- Westpac

- National Australia Bank (NAB)

- ANZ Bank

- Macquarie Business Finance

- Latitude Finance

- Pepper Money

- Prospa (for small business financing)

Each provider offers different terms, interest rates, and approval processes. Compare quotes before deciding.

⚖️ How to Choose Between Loan and Lease

Choosing between an equipment loan and a lease depends on your business goals.

| Factor | Loan (Chattel Mortgage) | Lease |

| Ownership | Yes | Optional |

| Upfront Cost | Deposit required | Often none |

| Flexibility | Limited | High |

| Equipment Type | Long-lasting assets | Fast-upgrading assets |

| Tax Benefits | Claim depreciation | Claim lease expense |

| End of Term | You own the asset | Return or buy at residual |

Quick Tip:

If you plan to keep the asset for more than 5 years, go for a loan.

If you plan to upgrade frequently, choose a lease.

🧾 Tax Benefits (Australia)

The Australian Taxation Office (ATO) allows certain deductions for business equipment finance.

For Equipment Loans

- Claim interest on repayments

- Claim depreciation each year (based on asset’s life)

For Equipment Leases

- Claim the full lease payment as a business expense

Also, under the Instant Asset Write-Off scheme (as per latest ATO updates), eligible small businesses may be able to claim immediate tax deductions for equipment purchases up to a certain limit.

(Always check ATO’s current guidelines or talk to your accountant.)

🔍 Key Things to Check Before You Apply

- Compare Interest Rates:

Even a 1% difference can change your total cost significantly. - Check Fees:

Application, documentation, or early termination fees can add up. - Understand Residual Value:

If leasing, ensure the residual or balloon amount is fair. - Read the Fine Print:

Some leases include maintenance or usage restrictions. - Match Loan Term to Equipment Life:

Don’t take a 7-year loan for equipment that lasts only 4 years. - Get Pre-Approval:

Helps you know your budget before making equipment decisions.

📉 Example: Impact of Interest Rate Change

Let’s see how interest rate affects total cost.

Equipment cost: AUD 50,000

Loan term: 5 years (60 months)

Deposit: 10% (AUD 5,000)

Loan amount: AUD 45,000

| Interest Rate | Monthly Payment | Total Payment | Interest Paid |

| 6% | AUD 870 | AUD 52,200 | AUD 7,200 |

| 8% | AUD 997 | AUD 59,820 | AUD 14,820 |

| 10% | AUD 1,064 | AUD 63,840 | AUD 18,840 |

✅ A 2% rise in interest can add AUD 7,000+ to your cost!

That’s why it’s important to compare and negotiate before signing.

🧠 Advantages and Disadvantages

| Advantages | Disadvantages |

| Keeps cash flow healthy | Interest cost adds up |

| May offer tax benefits | Asset may lose value |

| Easy approval | Risk of repossession if unpaid |

| Predictable payments | May include hidden fees |

| Allows upgrades | Lease can be expensive long-term |

🪙 Real-Life Example

Case Study: Sydney Construction Pty Ltd

Sydney Construction wanted to buy a bulldozer worth AUD 200,000 but didn’t want to use their cash reserves. They opted for a 5-year equipment loan at 7% interest with a 20% balloon payment.

- Loan amount = AUD 160,000

- Balloon = AUD 40,000

- Monthly repayment ≈ AUD 3,168

- Total repayment (60 months) = AUD 190,080

- Plus balloon = AUD 40,000

- Total = AUD 230,080

Even though they paid AUD 30,080 in interest, they preserved cash for payroll, fuel, and new projects — increasing annual profits.

🧭 Final Tips for Australian Businesses

- Always calculate the true cost (including fees and balloon payment).

- If leasing, check what happens if the equipment is damaged.

- Compare lenders and check for hidden fees.

- Talk to your accountant for the best tax deduction strategy.

- Plan repayments according to your business’s seasonal income.

Also Read: Financial Well Being Small Business: A Guide to Stability and Growth

✅ Conclusion

Equipment financing for business is a smart way to grow in Australia without hurting your cash flow. Whether you’re a café owner, builder, doctor, or farmer, it helps you access the latest tools to stay competitive.

By understanding how loans and leases work, comparing costs, and calculating repayments, you can choose the best option for your needs.

If you manage it wisely, equipment financing isn’t just about borrowing — it’s about building long-term growth for your business.