Finance and mathematics are deeply connected. Whether you are saving money, taking a loan, investing in stocks, or planning for retirement, you are using math every single time. Many people think finance is difficult, but when concepts are explained in simple language with examples, it becomes very easy to understand.

In this long, informative blog, you will learn how is math used in finance, understand important formulas, and see step-by-step examples using dollars. By the end, you will clearly understand how numbers help in making smart financial decisions.

What Is Financial Mathematics?

Financial mathematics means using math to solve money-related problems. It helps in:

- Calculating interest

- Understanding loans

- Estimating investment returns

- Measuring risk

- Deciding between financial options

Banks, investors, businesses, loan companies, insurance companies, and even individuals use financial math every day. Without math, it would be impossible to run the financial world.

Why Math Is Important in Finance

Math allows you to make decisions based on facts and numbers, not guesswork. It helps you know:

- How much your savings will grow

- How much interest you will pay on a loan

- Whether an investment is profitable

- How much risk you are taking

- What your future money will be worth

Let’s understand this with real examples in dollars.

Key Concepts: How Is Math Used in Finance

Below are the most important concepts, each explained in simple language with examples.

Compound Interest

Compound interest is interest on your money + the interest already earned. It is the heart of finance.

Formula

A=P×(1 + r)^n

Where:

- A = Final amount

- P = Initial amount

- r = Interest rate

- n = Number of years

Example 1 (Simple & Clear)

You invest $1,000 at 6% interest for 3 years.

A=1000×(1 + 0.06)^3

A=1000×1.191016=$1,191.02

So, after 3 years you will have $1,191.02.

Present Value and Future Value

Money today is more valuable than the same amount in the future because you can invest it.

Future Value Example

You want to know how much $2,000 will become in 5 years, at 7% interest.

FV=2000×(1.07)^5 = 2000 x 1.40255=$2,805.10

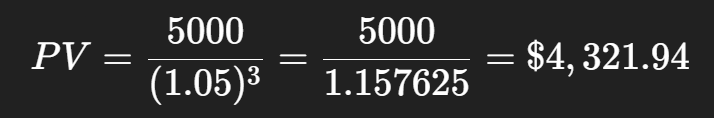

Present Value Example

You will receive $5,000 after 3 years.

Interest rate = 5%

So, $5,000 after 3 years is worth $4,321.94 today.

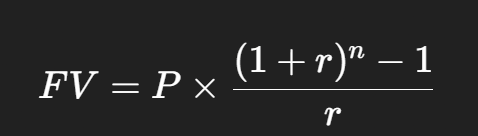

Annuities (Series of Payments)

An annuity is a series of equal payments—like monthly savings or loan installments.

Formula

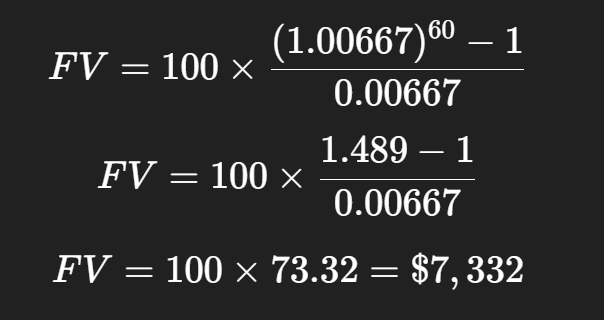

Example: Saving $100 per month

Monthly saving = $100

Interest = 8% per year, monthly = 0.00667

Years = 5 years = 60 months

So, saving $100 per month gives you $7,332 in 5 years.

Probability and Statistics in Finance

Finance involves risk. Statistics helps predict outcomes.

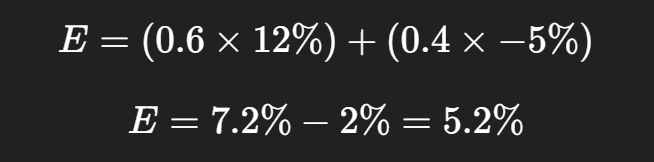

Example

A stock has two possible returns:

- +12% return → probability 60%

- –5% return → probability 40%

Expected Return:

Average expected return = 5.2%

Risk Measurements

Standard deviation, correlation, and variance are used to measure:

- How risky an investment is

- How much returns fluctuate

- How different assets move together

These help investors manage uncertainty.

Where Math is Used in Real Financial Life

Math is used everywhere. Here are clear examples.

Banking

Banks use math to:

- calculate loan interest

- set EMI payments

- determine mortgage affordability

- calculate savings returns

Example: Loan Interest Calculation

You take a $10,000 loan at 8% interest for 2 years.

Simple interest estimate:

Interest=P×r×t=10000×0.08×2=1600

Total repayment = $11,600

But banks usually compound interest monthly, making the cost slightly higher.

Investments

Investment math is used to:

- value stock portfolios

- calculate returns

- compare assets

- estimate future profit

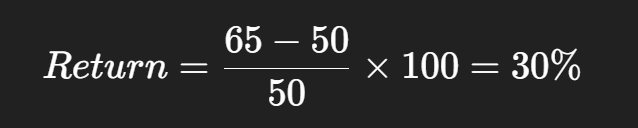

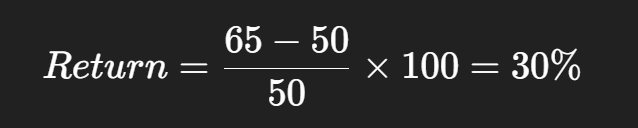

Example: Stock Return

You buy a stock for $50 and sell it for $65 after 1 year.

So you earned 30% return.

Retirement Planning

Planning long-term goals requires math.

Example: Saving $300 per month for 25 years

Interest = 7% yearly (0.583% monthly)

You will have $122,370 at retirement.

Budgeting

Math helps you organize:

- earnings

- expenses

- savings

- debts

Example

Monthly income = $3,000

Expenses = $2,200

Savings = $800 per month = $9,600 per year

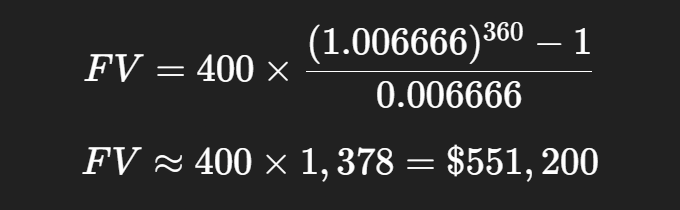

Large Combined Example: Full Lifetime Calculation

Let’s combine everything into one detailed scenario.

Scenario

You are 30 years old.

You want $1,000,000 at age 60 for retirement.

You can invest $400 per month at 8% yearly.

Let’s check if you will reach your goal.

Step 1: Calculate Monthly Rate

8% per year → monthly rate:

r=0.08/12=0.006666

Step 2: Number of Months

30 years × 12 = 360 months

Step 3: Use Annuity Formula

Final Result

You will have $551,200 — you need to increase your savings or investment returns to reach $1,000,000.

This example shows how math helps plan your financial future.

Common Mistakes in Financial Math

1. Ignoring Compounding

Small differences in compounding frequency change total results.

2. Forgetting Inflation

$1 today ≠ $1 in 20 years.

3. Assuming Returns Will Always Be the Same

Markets fluctuate. Use realistic expectations.

4. Not Understanding Loan Terms

Interest, APR, and compounding can change the cost heavily.

5. Overlooking Risk

High return = usually high risk.

Useful Formulas (Quick Reference Table)

| Concept | Formula | Explanation |

| Future Value | Growth of one amount | |

| Present Value | Today’s value of future money | |

| Annuity Future Value | Saving regularly | |

| Return | Profit percentage | |

| Expected Return | Average weighted return |

How Math Helps You Make Better Financial Decisions

- You can decide whether a loan is affordable.

- You can compare investment options.

- You can find out how much to save for retirement.

- You can estimate future costs like college, home, or travel.

- You can set a clear budget and long-term goals.

With math, money becomes predictable and manageable.

Also Read: What Is the Meaning of Finance?

Conclusion

Math is the backbone of finance. From compound interest to risk measurement, calculations help you understand how money grows, how loans work, and how to plan for the future. With simple formulas and clear examples like the ones in this blog, anyone can learn to make smarter financial decisions.

Finance becomes easy when you understand the numbers behind it.

The more comfortable you are with financial math, the stronger your financial future will be.