When money runs short and you need quick cash, a payday loan might look like an easy option. Many people think, “I just need $1000 until my next paycheck.” But before you apply, it’s very important to understand how much would a $1000 payday loan cost.

This guide explains the total cost, interest, examples, and alternatives — in very simple language. Let’s begin.

What Is a Payday Loan?

A payday loan is a short-term loan that helps you cover emergency expenses until you get your next paycheck.

You usually borrow a small amount (like $100–$1,000) and agree to pay it back within two to four weeks.

But payday loans are very expensive because of high fees and short repayment time.

Main Features of Payday Loans

- You borrow a small amount (example: $1000).

- Repayment is usually due on your next payday (around 14 to 30 days).

- The lender charges a fee per $100 borrowed, not a normal annual interest.

- No credit check is needed in many cases.

- If you can’t repay, you may “roll over” the loan — which adds more fees.

How Do Payday Loan Fees Work?

Most payday lenders charge between $15 and $30 per $100 borrowed.

So, if you borrow $1000, the fee could be between $150 and $300 depending on the lender and state law.

For example:

- $15 × 10 = $150 fee

- $20 × 10 = $200 fee

- $30 × 10 = $300 fee

So, the total amount to repay after 14 days will be:

- $1150, $1200, or $1300

Even though that fee looks small, when you calculate it as annual percentage rate (APR), it becomes extremely high.

How to Calculate Payday Loan APR (Annual Percentage Rate)

APR helps you understand how expensive a loan is in a year.

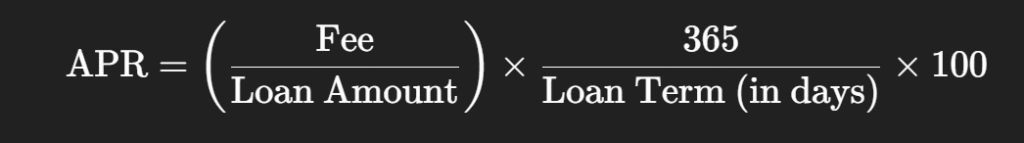

APR Formula

Let’s calculate with an example 👇

Example 1: Two-Week $1000 Payday Loan

- Loan Amount: $1000

- Fee: $20 per $100 → Total Fee = $200

- Loan Term: 14 days

Step 1: Plug into the formula

APR=(200/1000)×(365/14)×100

Step 2: Solve

APR=0.2×26.07×100=521.4%

✅ Result: The APR is about 521%.

That means borrowing $1000 for just two weeks costs $200, but if you kept that loan for a year at the same rate, it would equal 521% interest per year!

Example 2: $1000 Loan for One Month (Extended)

If you can’t repay after two weeks and extend (or “roll over”) the loan for another two weeks, you’ll pay another fee.

- Fee per 2 weeks = $200

- Extended once = $200 × 2 = $400 total fees

You now owe $1400 for borrowing $1000 for one month.

Let’s check the APR again:

APR=(400/1000)×(365/28)×100

APR=0.4×13.04×100=521.6%

So the APR stays roughly the same, but you’ve paid double the fee.

Example 3: $1000 Loan Rolled Over for 2 Months

Now imagine you can’t repay for two months and keep extending:

- $200 fee × 4 times (every 2 weeks) = $800 fees

- Total owed = $1000 + $800 = $1800

Even though you only borrowed $1000, you’ll pay $800 in just 2 months — that’s 80% of the original amount!

Example 4: $1000 Loan Rolled Over for 6 Months

Many people get trapped and keep rolling over payday loans.

Let’s say you keep paying $200 every two weeks for 6 months (about 12 rollovers):

- $200 × 12 = $2400 in fees

- Total owed = $1000 + $2400 = $3400

That’s 3.4 times the money you borrowed!

Quick Comparison Table: How Much Would a $1000 Payday Loan Cost?

| Loan Duration | Fee Per $100 | Total Fee | Total Owed | Approx APR |

| 2 weeks | $20 | $200 | $1,200 | 521% |

| 1 month | $20 | $400 | $1,400 | 521% |

| 2 months | $20 | $800 | $1,800 | 365% |

| 6 months | $20 | $2,400 | $3,400 | 520%+ |

As you can see, the longer you hold the loan, the higher the total cost.

Why Payday Loans Are So Expensive

Payday lenders charge high fees because:

- Short Term – You borrow for only 2–4 weeks.

- High Risk – Lenders lend to people with poor or no credit history.

- No Collateral – There’s nothing to secure the loan.

- Quick Processing – Money is approved fast, often same day.

- Lack of Regulation in Some Areas – Some states have very high fee limits.

While a lender might only advertise “$15 per $100 borrowed,” it hides the fact that this equals 391% APR if kept for a year.

Understanding the Real Cost

A payday loan looks easy because:

- You can get money instantly.

- No long paperwork.

- Easy approval.

But the real cost isn’t just the fee.

If you roll over the loan, the cost can become huge.

Let’s break it down again:

- Borrow $1000

- Pay back $1200 in two weeks

- Roll over three times → pay $200 × 3 = $600 more

- Total = $1800

That means you paid $800 in fees just to borrow $1000 for two months!

How Payday Loans Can Trap You in Debt

Many people cannot repay the full amount in one paycheck.

So they:

- Pay only the fee ($200), and

- Roll over the loan for another two weeks.

This looks easier, but every time you roll over, you add new fees — and your debt never decreases.

Eventually, you could end up paying more in fees than the money you borrowed.

This is why payday loans are often called “debt traps.”

Is It Legal to Charge So Much?

Yes — payday loans are legal in most U.S. states, but each state has its own laws:

- Some states limit the maximum fee (for example, $15 per $100).

- Others allow higher fees or unlimited rollovers.

- A few states, like New York, ban payday loans altogether.

Before borrowing, always check your state’s payday loan rules.

Alternatives to a $1000 Payday Loan

If you’re short on money, here are better and cheaper options:

1. Personal Loans

Banks and online lenders offer small personal loans with APR between 10%–35%.

- For example, a $1000 personal loan at 20% APR for 6 months = about $55 interest total — much less than $200 per two weeks.

2. Credit Union Payday Alternative Loans (PALs)

Some credit unions offer “PALs”:

- Borrow $200–$1000

- Repay in 1–6 months

- APR capped at 28%

Example: $1000 × 28% APR for 3 months → interest ≈ $70.

3. Borrow from Friends or Family

It can be awkward, but you can save hundreds in fees. Just agree on repayment terms in writing.

4. Use a Credit Card

If you have available credit, a short-term use can be cheaper.

Example: $1000 for one month at 25% APR = around $20 interest, not $200.

5. Negotiate With Billers

If you need a payday loan to pay bills, call the company and ask for an extension or payment plan. Many will agree.

How to Avoid Payday Loan Debt

Here are a few practical tips:

- Create an Emergency Fund: Save a small amount monthly (even $20 helps).

- Track Spending: Avoid small unnecessary expenses that add up.

- Look for Side Income: Freelancing or part-time work can build savings.

- Ask for Employer Advance: Some companies allow small paycheck advances.

- Use Financial Counseling Services: Nonprofits can guide you for free.

Example: Comparing Payday vs. Personal Loan

| Details | Payday Loan | Personal Loan |

| Amount Borrowed | $1000 | $1000 |

| Term | 2 weeks | 6 months |

| Fee/Interest | $20 per $100 ($200) | 20% APR |

| Total Payback | $1200 in 14 days | ~$1055 in 6 months |

| APR | ~521% | 20% |

| Monthly Burden | One payment | Small monthly payments |

| Risk | Very high | Low |

✅ A personal loan is clearly cheaper and safer.

Real-Life Example

Sarah borrowed $1000 for emergency car repair.

The lender charged her $20 per $100 → $200 fee.

She couldn’t pay it back after two weeks, so she rolled it over twice.

That means $200 × 3 = $600 fees total.

Finally, she repaid $1600 after six weeks.

If she had taken a personal loan at 20% APR for 2 months, she would have paid only about $33 in interest.

So, Sarah spent $567 more just for quick access to cash.

Pros and Cons of Payday Loans

| Pros | Cons |

| Quick cash for emergencies | Extremely high cost |

| Easy approval, even with bad credit | Can trap you in debt |

| Simple process | Short repayment time |

| No credit check | High APR (300–700%) |

Also Read: Can You Pay Off Student Loan Early Without Penalty Australia

Final Thoughts

A $1000 payday loan may look simple, but it can cost you $1200 or more within two weeks, and much more if you can’t repay on time. The real annual cost (APR) can reach 500% or higher, which is far beyond traditional loans.

If you truly need quick money, explore personal loans, credit union PALs, or credit cards — they can save you hundreds of dollars.

Always remember: Payday loans are for emergencies only, and even then, they should be your last option.