Many students ask the same question: “Is finance a lot of math?”

Maybe you like money, business, and the stock market, but you are afraid of mathematics. You imagine long formulas, scary equations, and tough calculations every day. Because of this fear, many students avoid finance as a subject or as a career.

The good news is:

👉 Most finance jobs and courses do not need very advanced math.

You usually need basic arithmetic and simple algebra, plus smart use of tools like Excel and financial calculators.

In this blog, we will clearly explain:

- How much math is used in finance

- What type of math you really need

- Different finance careers with low, medium, and high math levels

- Simple examples with calculations

- Tips for students who are scared of math but interested in finance

Let’s understand this step by step in very easy language.

Why People Think Finance Is Full of Hard Math

When people hear the word “finance”, they often imagine:

- Complicated graphs

- Big equations

- Traders shouting numbers on TV

- Charts full of formulas

Because of this picture, students think:

“To study finance, I must be a math genius.”

But this is not true for most finance areas.

In real life, many finance roles are about:

- Understanding how money moves

- Making smart decisions

- Communicating ideas to clients

- Managing risk and planning for the future

Yes, math is used. But in many cases, it is basic, repeatable, and tool-supported.

What Kind of Math Is Actually Used in Finance?

Let’s see what type of math is helpful in finance. You will see that most of it is not scary.

Basic Arithmetic

This is the math you learn in school:

- Addition (+)

- Subtraction (−)

- Multiplication (×)

- Division (÷)

You use this to:

- Add incomes and expenses

- Calculate profit or loss

- Work with percentages

Example 1: Profit Calculation

A small shop sells a toy for $50.

The cost to buy that toy from the wholesaler is $35.

Profit = Selling Price − Cost Price

= $50 − $35

= $15 profit per toy

If the shop sells 20 toys:

Total profit = $15 × 20 = $300

This is very simple math, but it is still finance.

Percentages and Ratios

Percentages are very important in finance. They help you understand:

- Interest rates

- Growth rates

- Profit margins

Example 2: Profit Margin

Using the same toy example:

- Cost price = $35

- Selling price = $50

- Profit = $15

Profit Margin (%) = (Profit ÷ Selling Price) × 100

= ($15 ÷ $50) × 100

= 0.30 × 100

= 30%

So, the shop earns a 30% profit margin on each toy. That’s simple division and multiplication.

Simple Algebra

Sometimes, you use small formulas with unknown values (like x, y). This is basic algebra.

Example 3: Finding Selling Price for a Target Profit

Suppose a shop wants a 25% profit on a toy that costs $40.

Let selling price be X.

Profit = X − 40

Profit % = (Profit ÷ X) × 100 = 25%

So:

[(X−40)/X]×100=25

Divide both sides by 100:

[X−40]/X=0.25

Now:

X − 40 = 0.25X

X − 0.25X = 40

0.75X = 40

So:

X=40/0.75≈53.33

To get 25% profit, the shop should sell the toy for about $53.33.

Again, this is just small algebra. With practice, it becomes easy.

Time Value of Money (TVM)

In finance, we often compare money now with money in the future. This is called time value of money.

There are formulas, but most people use Excel or a financial calculator. You just enter:

- Present amount

- Interest rate

- Number of years

The tool does the calculation for you.

Example 4: Simple Interest (Easy Calculation)

If you invest $1,000 at 5% simple interest per year for 3 years, how much will you have?

Simple Interest = Principal × Rate × Time

= $1,000 × 5% × 3

= $1,000 × 0.05 × 3

= $150

Total amount after 3 years = Principal + Interest

= $1,000 + $150

= $1,150

This is basic multiplication.

Using Excel Instead of Manual Math

In modern finance, tools are very important. Excel can:

- Add, subtract, multiply, and divide automatically

- Use formulas like =PMT, =FV, =PV for loans and investments

- Make tables, charts, and reports

This means you do not have to calculate everything by hand.

Your main job is to understand what the numbers mean and how to use them for decisions.

Types of Finance Careers: How Much Math Do They Use?

Not all finance jobs are the same. We can divide them into three groups:

Low-Math Finance Careers

These roles use basic math and focus more on people, communication, and planning.

Examples:

- Personal Financial Advisor (for regular people)

- Relationship Manager at a bank

- Insurance Sales and Advisory

- Finance-related HR, PR, or marketing roles

- Customer service in financial companies

What math do they use?

- Basic arithmetic

- Percentages (interest, returns, insurance premiums)

- Simple comparisons (Plan A vs Plan B)

Example: Insurance Advisor

An insurance advisor may compare two plans for a client:

- Plan A premium: $600 per year

- Plan B premium: $720 per year

Difference = $720 − $600 = $120

The advisor explains:

“You pay $120 more per year in Plan B, but you get higher coverage and more benefits.”

This is simple math plus communication.

Medium-Math Finance Careers

These roles need comfortable basic math and sometimes slightly higher math, but not too advanced. Tools are used heavily.

Examples:

- Investment Banking

- Corporate Finance

- Financial Planning & Analysis (FP&A)

- Equity Research

- Risk Management (basic to mid level)

- Asset Management, Portfolio Analysis

What math do they use?

- Percentages and growth rates

- Ratios (like debt-to-equity, current ratio)

- Basic statistics (average, variance in simple form)

- Some algebra-based formulas

- Heavy use of Excel

Example: Growth Rate of a Company

A company made $200,000 profit last year and $240,000 this year.

Growth Rate (%) = ((New − Old) ÷ Old) × 100

= (($240,000 − $200,000) ÷ $200,000) × 100

= ($40,000 ÷ $200,000) × 100

= 0.20 × 100

= 20% growth

This type of calculation is very common in finance and is quite simple.

High-Math Finance Careers

These roles need strong mathematics and statistics. They are more technical and often well-paid.

Examples:

- Quantitative Analyst (Quant)

- Algorithmic Trading

- Actuary

- Advanced Risk Modelling

- Financial Engineering

What math do they use?

- Calculus

- Linear algebra

- Probability and advanced statistics

- Complex models, programming

If you love math, these careers can be great. But if you don’t, you can still work in finance in many other roles.

Is Finance Course in College Full of Math?

If you choose finance as a major or specialization in college, you might have:

- Basic math and statistics courses

- Accounting

- Corporate finance

- Investment analysis

- Financial markets

Many students are surprised that:

- A large part of the course focuses on concepts, theory, and case studies, not just equations.

- In assignments, they use Excel and calculators, not only pen-and-paper calculations.

There may be some formulas, but with practice and support, they become manageable.

Simple Loan Example: How Math Works in Daily Finance

Let’s look at a practical loan example with numbers.

Example 5: Monthly EMI Calculation (Conceptual)

Suppose you take a loan of $10,000 at 12% annual interest, to be paid over 2 years (24 months).

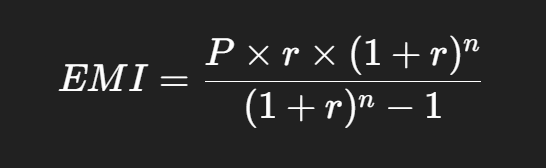

The exact EMI formula is:

Where:

- P = loan amount

- r = monthly interest rate

- n = number of months

This looks scary, right?

But in real life, you do not calculate it manually.

You can:

- Use an online EMI calculator

- Use an Excel formula: =PMT(rate, nper, -pv)

For example, in Excel:

- Rate = 12%/12 = 1% per month

- Nper (number of periods) = 24 months

- Pv (present value) = 10000

Formula:

=PMT(0.01, 24, -10000)

Excel will give the monthly EMI automatically.

Your job is to understand what EMI means, how interest is charged, and whether the loan is affordable.

So again, finance is not only about solving formulas. It is mainly about using tools and making decisions.

If You Are Weak in Math, Can You Still Study Finance?

Yes, you can.

Here’s why:

- Most required math is basic.

If you are comfortable with school-level arithmetic and some algebra, you can handle it. - You can improve your math slowly.

You do not need to be perfect. You just need to be willing to practice. - Tools help you with calculations.

Excel, calculators, and software take care of the hard part. - Finance values other skills too:

- Communication

- Critical thinking

- Problem-solving

- Teamwork

- Presentation skills

- Communication

Many successful finance professionals are not “math geniuses.”

They are good communicators, quick learners, and careful thinkers.

How to Prepare for Finance If You Are Afraid of Math

Here are some practical tips:

Strengthen Your Basics

- Practice addition, subtraction, multiplication, and division daily.

- Revise percentages: 10%, 20%, 5%, 12.5% etc.

- Use real-life examples: discounts in shops, bank interest, etc.

Mini Exercise:

A product costs $80. There is a 15% discount.

Discount = 15% of $80 = 0.15 × 80 = $12

Final price = $80 − $12 = $68

If you can do this, you are already using finance math.

Learn Excel

Excel is your best friend in finance.

Start with:

- Addition: =A1 + B1

- Percentage: =A1 * 0.05 (for 5% of A1)

- Simple interest table

- Using basic functions like SUM, AVERAGE, MAX, MIN

Later, you can learn financial functions like:

- =PV (present value)

- =FV (future value)

- =PMT (EMI calculation)

You do not need to know the formula behind them in detail at first. You only need to understand what they are used for.

Choose the Right Finance Path

If you do not like advanced math, avoid highly technical roles like quantitative finance or actuarial science.

Instead, focus on:

- Personal finance advising

- Corporate finance (at basic to medium level)

- Banking operations

- Wealth management

- Financial planning

- Sales and relationship roles in financial companies

These still use math, but it is mostly basic and tool-supported.

So… Is Finance a Lot of Math?

Let’s answer the main question clearly.

Short Answer

- Finance does use math, but

- Most of it is basic (arithmetic, percentages, simple algebra)

- Only some specialized jobs use very advanced math

You do not need to be a math genius to study finance or to work in most finance jobs.

What Really Matters in Finance?

In many finance roles, more important than advanced math are:

- Understanding of money concepts (profit, loss, interest, risk)

- Ability to analyze information

- Skill to explain numbers in simple language

- Decision-making and planning

- Communication skills

So if you are:

- Curious about money and markets

- Ready to practice basic math

- Willing to learn tools like Excel

…then you can absolutely choose finance as a study or career option.

Also Read: Why Finance Is Important

Final Thoughts

The fear of math stops many students from exploring a wonderful field like finance. But now you know the truth:

- Finance is not just about long equations.

- It is about understanding money, making smart choices, and helping people or businesses plan their future.

- Most of the time, you use basic math and modern tools, not a blackboard full of symbols.

So, if you are asking “Is finance a lot of math?”, the honest answer is:Finance uses some math, but you don’t need to be a math expert.

With basic skills, practice, and tools, you can do very well in finance.