Financial planning is more than just managing money—it’s about shaping your future, securing your lifestyle, and achieving financial freedom. Whether you’re a young professional in Sydney, a family in Melbourne, or planning for retirement in Perth, understanding the importance of financial planning can make all the difference. In this blog, we’ll explore 6 top reasons why youll want to invest in financial planning, complete with examples, calculations, and actionable tips.

6 Top Reasons Why Youll Want to Invest in Financial Planning

1. Provides Clear Financial Goals

A financial plan gives you a roadmap to achieve your financial aspirations. Without clear goals, it’s easy to overspend or misallocate your resources. Financial planning helps you identify short-term, medium-term, and long-term objectives.

Example and Calculation

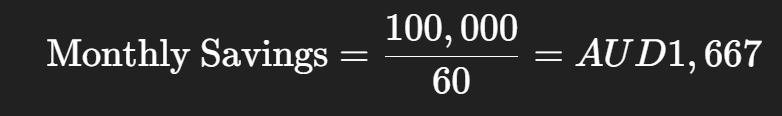

Suppose you aim to save AUD 100,000 for a home deposit in 5 years.

- Total savings needed: AUD 100,000

- Timeframe: 5 years (60 months)

Monthly savings required:

By understanding this target, you can adjust your budget, cut unnecessary expenses, or find additional income streams to meet your goal.

2. Enhances Financial Awareness

Financial planning encourages monitoring of your income, expenses, and investments. For Australians, this could include tracking everyday expenses like groceries, utilities, or superannuation contributions.

Example

A Melbourne family notices AUD 2,000 per month is being spent on non-essential items such as dining out and subscriptions. By cutting back 25%, they can save AUD 500 monthly, which can be redirected into an emergency fund or investment account.

This level of financial awareness prevents debt accumulation and ensures money is working for you.

3. Prepares for Emergencies

Unexpected situations like medical emergencies, car repairs, or sudden unemployment can happen at any time. A solid financial plan includes an emergency fund to cover at least 3–6 months of living expenses.

Example and Calculation

- Monthly living expenses: AUD 4,000

- Emergency fund (6 months):

4,000×6=AUD24,000

By maintaining this fund in a high-interest savings account, you’re protected from having to take loans or credit card debt when emergencies arise.

4. Optimizes Investment Strategies

Financial planning helps you align your investments with your risk tolerance, goals, and time horizon. Australia has several options, including shares (ASX), managed funds, ETFs, and property investments.

Example

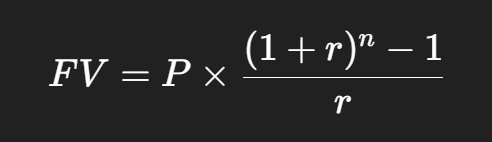

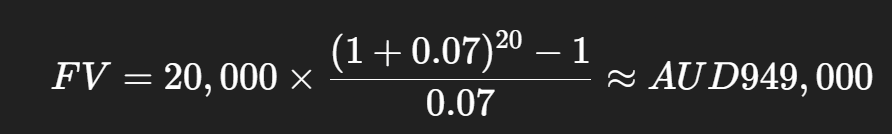

A 30-year-old investor in Sydney decides to invest AUD 20,000 annually in a diversified portfolio: 70% in shares and 30% in bonds. Assuming an average annual return of 7%, after 20 years, the investment grows to:

Where:

- P = AUD 20,000 (annual contribution)

- r = 0.07

- n = 20 years

Strategic investment planning ensures your money grows efficiently, helping you reach long-term financial goals.

5. Ensures Retirement Security

Superannuation is a cornerstone of retirement planning in Australia. Financial planning helps you estimate your retirement needs and take steps to ensure a comfortable lifestyle.

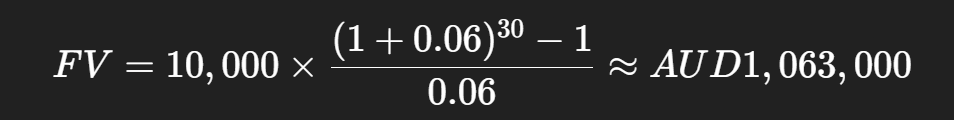

Example and Calculation

Assume a 35-year-old contributes AUD 10,000 per year to superannuation, with employer contributions included. Assuming an annual return of 6%, by age 65 (30 years), the fund grows to:

With proper planning, you can supplement superannuation with other investments to maintain your desired retirement lifestyle.

6. Facilitates Wealth Transfer and Estate Planning

A financial plan ensures your assets are managed and passed on according to your wishes. This includes wills, trusts, and insurance, reducing legal complications and taxes for heirs.

Example

An Australian retiree has AUD 500,000 in assets and sets up a testamentary trust for their children. Proper planning ensures that the estate is distributed efficiently, avoiding disputes and additional taxation.

Also Read: Family Financial Planner How They Help Australian

Bonus Tips for Australian Investors

- Regularly Review Your Plan: Market conditions and personal circumstances change, so revisit your plan at least annually.

- Use Professional Advice: Financial advisers can tailor strategies to your needs, ensuring tax efficiency and compliance with Australian regulations.

- Leverage Technology: Use apps and online tools to track investments, savings, and superannuation.

Conclusion

Investing in financial planning is essential for every Australian, whether you’re saving for a home, building wealth, or planning for retirement. A well-structured plan provides clear goals, financial awareness, emergency preparedness, investment optimisation, retirement security, and wealth transfer solutions.

By taking proactive steps and incorporating these six key reasons into your strategy, you can secure your financial future and enjoy peace of mind.