In Australia, managing family finances can be challenging. From daily expenses to long-term goals like buying a home, funding children’s education, or planning for retirement, families often struggle to make smart financial decisions. A family financial planner can help navigate these challenges, offering expert guidance tailored to your unique situation. In this blog, we’ll explain exactly how family financial planner how they help Australians in achieving financial stability and growth, with real-life examples and simple calculations.

What Is a Family Financial Planner?

A family financial planner is a certified professional who works closely with families to manage money effectively. They provide advice on:

- Budgeting and expense tracking

- Debt management

- Saving and investing

- Retirement planning

- Tax strategies

- Estate planning and insurance

Their goal is to create a comprehensive financial plan that aligns with your family’s income, lifestyle, and financial objectives.

Family Financial Planner How They Help

1. Setting Clear Financial Goals

Financial planners help families define and prioritise goals. Examples include:

- Saving $50,000 for a house deposit in five years

- Building a $20,000 emergency fund

- Funding children’s university education

Example: If a family wants to save $50,000 for a home in five years, the planner calculates monthly savings:

50,000÷60 months=$833 per month50,000 ÷ 60 \text{ months} = \$833 \text{ per month}50,000÷60 months=$833 per month

With an average investment return of 4% annually, this monthly saving could reduce to around $800, making the goal more achievable.

2. Creating a Realistic Budget

Planners assess income and expenses, helping families track spending and identify savings opportunities.

Example: A family earns $8,000/month and spends:

- Rent: $2,500

- Utilities & bills: $1,200

- Groceries: $1,000

- Transport: $800

- Entertainment: $700

- Savings: $500

A planner may suggest cutting non-essential spending (like entertainment) by $200/month, redirecting it to savings or debt repayment.

3. Building an Emergency Fund

Unexpected expenses like car repairs or medical bills can derail finances. Planners recommend saving 3–6 months of living expenses.

Example: Monthly expenses = $6,000 → emergency fund target = $18,000–$36,000. This provides financial security in case of job loss or emergency.

4. Managing Debt Effectively

High-interest debts, especially credit cards, can limit financial growth. Planners develop strategies to pay off or consolidate debt.

Example: Family has $15,000 in credit card debt at 18% interest. Paying only the minimum ($300/month) takes years and incurs high interest. A planner may suggest a personal loan at 10% interest, reducing total repayment and freeing funds for investment.

5. Saving and Investing for the Future

Financial planners guide families on where to save or invest based on risk tolerance and time horizon:

- Superannuation contributions

- Term deposits

- Exchange-traded funds (ETFs)

- Managed funds

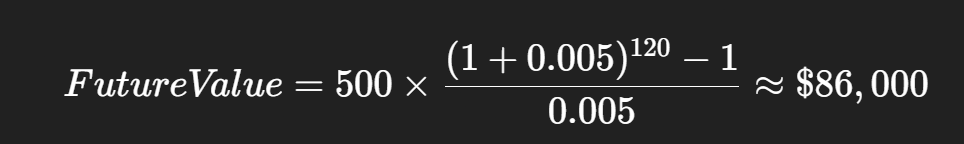

Example: Investing $500/month in an ETF with a 6% annual return over 10 years grows approximately to $86,000.

6. Planning for Retirement

Australian families can benefit from strategies to maximise superannuation, government incentives, and private investments. Planners estimate retirement needs and recommend contributions to ensure a comfortable lifestyle.

Example: A couple plans to retire at 65 with $1 million. Current super balance: $300,000. Planner calculates monthly contributions and investment growth needed to reach target.

7. Protecting Against Risks

Insurance is essential for financial protection against illness, accident, or death. Planners review:

- Life insurance

- Income protection

- Health insurance

- Home & contents insurance

Example: If a parent earning $100,000/year dies unexpectedly, life insurance payout can cover mortgage, living expenses, and children’s education.

8. Estate Planning

Planners assist families in writing wills, setting up trusts, and designating beneficiaries. This ensures assets are transferred according to wishes while minimising taxes.

Example: Parents can create a trust for $200,000 inheritance for children, which reduces estate tax and ensures funds are used as intended.

9. Tax Planning

Proper tax planning reduces liabilities through deductions, super contributions, and investment strategies.

Example: Contributing $10,000 to super can reduce taxable income, saving approximately $2,500 in taxes (assuming 25% marginal tax rate).

10. Providing Ongoing Support and Adjustments

Family finances change with income, lifestyle, and children’s needs. Planners provide regular reviews and adjust plans to keep families on track.

Real-Life Example: The Mitchell Family in Sydney

The Mitchells, with two children, approached a family financial planner:

- Goal: Buy a home in 4 years

- Required deposit: $80,000

- Monthly savings: $80,000 ÷ 48 = $1,667

- Planner suggested a diversified investment to reduce required monthly savings to $1,600

- Debt: $25,000 car loan

- Planner recommended refinancing to lower interest from 12% → 7%, saving $600/year

- Education: Children’s future tuition

- Planner set up a Junior Investment Account, contributing $200/month at 5% growth → $14,000 in 10 years

- Retirement: Super balance $150,000; target $700,000

- Monthly extra contribution: $1,200

- Emergency Fund: $36,000 target → $750/month over 4 years

- Insurance: Reviewed life and income protection, recommended additional coverage of $500,000

Result: Mitchell family now has a clear roadmap, lower debt, growing savings, and protected future, giving them peace of mind.

Also Check: 5 Characteristics of a Professional Financial Advisor

Why Every Australian Family Should Consider a Financial Planner

- Expertise in tax laws, superannuation, and investment options

- Tailored strategies based on individual circumstances

- Reduces financial stress and conflict within family

- Provides accountability and discipline for long-term goals

Tips for Choosing the Right Financial Planner

- Check credentials: Look for Certified Financial Planner (CFP) accreditation

- Experience with families: Ensure they understand family-specific challenges

- Transparent fees: Fee-only planners avoid commission-based bias

- Communication style: Should explain complex topics in simple terms

- Ongoing support: Financial planning is continuous, not one-off

Conclusion

A family financial planner is more than just a money advisor—they are partners in achieving financial security and peace of mind. For Australian families, consulting a professional can make a dramatic difference in managing debt, growing wealth, planning retirement, and securing children’s future. With clear goals, realistic budgets, smart investments, and risk management, a family financial planner helps you turn financial dreams into reality.