Managing your finances can be complicated. From saving for retirement to investing wisely, Australians face numerous financial decisions every day. Hiring a financial advisor can help you make informed choices, maximise your wealth, and secure your financial future. This guide will explain everything you need to know about getting financial advisor guide in Australia, including types of advisors, fees, tips, and examples.

Why You Might Need a Financial Advisor in Australia

Financial advisors are experts who help you manage your money, investments, and financial planning. Here’s why Australians often seek a financial advisor:

- Retirement Planning: Australians want to grow their superannuation and plan post-retirement income.

- Investment Guidance: To choose stocks, bonds, ETFs, or property wisely.

- Debt Management: Advisors can help manage mortgages, personal loans, or credit cards.

- Life Events: Major life events like marriage, having children, or receiving an inheritance often require expert advice.

- Tax Planning: To legally reduce taxes and maximise deductions.

Types: Getting Financial Advisor Guide

Understanding the types of advisors helps you find the right fit:

- Independent Financial Advisors (IFA): Provide unbiased advice across all financial products.

- Restricted Advisors: Offer advice on limited products or specialise in pensions, superannuation, or insurance.

- Robo-Advisors: Digital platforms offering automated investment advice with low fees.

How to Choose the Right Financial Advisor

Follow these steps to select the best advisor:

1. Identify Your Needs

Determine whether you need investment planning, retirement advice, debt management, or tax planning.

2. Check Credentials

In Australia, advisors should hold an Australian Financial Services (AFS) licence and certifications like Certified Financial Planner (CFP).

3. Interview Multiple Advisors

Meet at least 2–3 advisors. Ask about their experience, investment approach, and client success stories.

4. Evaluate Communication Style

Choose someone who explains concepts clearly and understands your goals.

Understanding Financial Advisor Fees in Australia

Financial advisor fees can vary. Common structures include:

- Percentage of Assets Under Management (AUM): Typically 0.5%–1.5% per year.

- Example: If you invest $200,000 and the fee is 1% AUM, you pay $2,000 annually.

- Hourly Fees: $150–$500 per hour depending on expertise.

- Flat Fees: A fixed $2,000–$10,000 for specific financial plans.

- Commission-Based: Earnings from selling products, less common due to potential bias.

Tip: Always confirm fees upfront to avoid surprises.

What to Expect in Your First Meeting

Your first session is crucial. Prepare to:

- Share Financial Information: Income, expenses, debts, superannuation, and investments.

- Discuss Goals: Short-term (saving for a car) and long-term (retirement planning).

- Ask Questions: About services, fees, and how they measure success.

- Review Documents: Bank statements, superannuation statements, insurance policies.

Example Financial Plan with Calculations

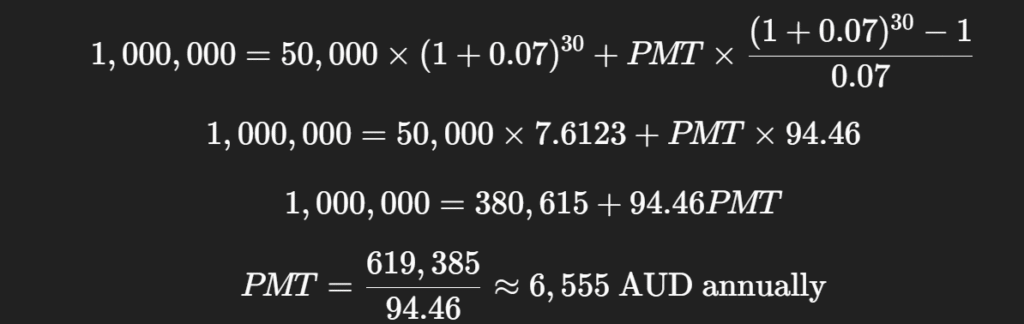

Scenario: You are 35, have $50,000 in superannuation, and want $1,000,000 by age 65.

- Time Horizon: 30 years

- Expected Annual Return: 7%

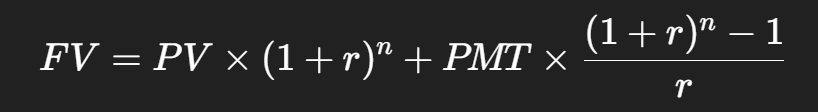

- Required Contribution Calculation (Future Value formula):

Where:

- FV = future value ($1,000,000)

- PV = present value ($50,000)

- r = annual interest rate (7% = 0.07)

- n = number of years (30)

- PMT = annual contribution

Calculation:

So, contributing about $6,555 annually with a 7% return helps you reach $1,000,000 by retirement.

Common Financial Advisor Certifications in Australia

- Certified Financial Planner (CFP): Expertise in comprehensive planning.

- Chartered Financial Analyst (CFA): Focused on investments and portfolio management.

- CPA or Chartered Accountant (CA): Useful for tax and accounting services.

Alternatives to Traditional Financial Advisors

If you prefer alternatives:

- Robo-Advisors: E.g., Stockspot or Six Park, for low-cost investment management.

- Financial Guidance Services: Free advice from organisations like MoneySmart by ASIC.

- DIY Tools: Budgeting apps like Pocketbook or investment calculators.

Tips to Ensure You Get the Right Advice

- Check Qualifications: Verify licenses and certifications.

- Ask for References: Speak with other clients.

- Avoid High-Pressure Sales: Good advisors provide time to decide.

- Review Regularly: Track your portfolio and goals with your advisor at least annually.

Also Check: What Do Financial Advisers Deal With?

Conclusion

Hiring a financial advisor in Australia can be transformative for your financial journey. By understanding the types of advisors, their fees, and the right questions to ask, you can choose a professional who aligns with your goals. Whether it’s planning for retirement, managing investments, or saving for major life events, a trusted advisor can help you make informed, strategic financial decisions. Remember, the earlier you start planning, the better your chances of achieving financial freedom.