Buying your first home is one of the most exciting steps in life. But before you apply for a mortgage or look for home loan benefits, it’s important to understand what “first-time home buyer” actually means.

Many people think a first-time home buyer is someone who has never owned a house before — but that’s not always true. According to mortgage and housing guidelines, even if you owned a home years ago, you may still qualify as a first-time home buyer today.

In this detailed blog, we’ll explain everything you need to know about what is considered a first time home buyer — from the official definition, qualifications, benefits, and government programs, to real-life examples and simple dollar-based calculations that will help you understand the complete picture.

🏡 Definition: What Is Considered a First-Time Home Buyer?

A first-time home buyer is generally defined as:

“Someone who has not owned a primary residence during the past three years.”

This means that even if you owned a home before — as long as you haven’t owned or lived in a primary residence for the last three years, you can qualify as a first-time home buyer again.

Examples

| Scenario | Considered First-Time Buyer? | Reason |

| You’ve never owned a home | ✅ Yes | You’re a new buyer. |

| You sold your last home 4 years ago | ✅ Yes | You haven’t owned for over 3 years. |

| You owned a rental property but rent your main home | ✅ Possibly | It depends on the loan program. |

| You owned a home 1 year ago | ❌ No | You still fall within the 3-year window. |

| You lived in a mobile home (not on a foundation) | ✅ Yes | It may not count as “ownership.” |

So, you could be a “first-time” buyer again — even after owning a house in the past.

🏦 Why It Matters to Be a First-Time Home Buyer

Being classified as a first-time home buyer can open many financial doors. Various federal and state programs in the U.S. offer special benefits, such as:

- Low down payment options (as little as 3%)

- Lower interest rates

- Government-backed loans (FHA, USDA, VA)

- Grants and assistance programs

- Tax credits and closing cost help

Let’s explore these benefits one by one.

💰 Financial Benefits for First-Time Home Buyers

1. Lower Down Payment Options

Normally, buyers need a 10–20% down payment.

But first-time home buyers can pay as little as 3% using special programs.

Example Calculation:

| Home Price | Standard 10% Down | First-Time Buyer 3% Down | Savings |

| $300,000 | $30,000 | $9,000 | $21,000 |

You save $21,000 upfront, which makes homeownership more achievable.

2. Lower Interest Rates

Lenders often offer slightly lower interest rates to first-time buyers under government programs. Even a 0.25% reduction can save you thousands.

Example:

- Loan amount: $300,000

- 30-year fixed rate:

- 7.0% regular buyer → monthly = $1,996

- 6.75% first-time buyer → monthly = $1,946

- 7.0% regular buyer → monthly = $1,996

That’s a $50 monthly saving, or about $18,000 over 30 years.

3. Government Programs

Here are the main programs that support first-time buyers:

| Program | Minimum Down Payment | Credit Score | Key Benefit |

| FHA Loan | 3.5% | 580 | Flexible credit requirements |

| Conventional 97 Loan | 3% | 620 | Only 3% down for eligible buyers |

| USDA Loan | 0% | 640 | For rural homebuyers |

| VA Loan | 0% | None | For veterans; no mortgage insurance |

4. Grants and Assistance

Many state and local housing agencies offer grants (free money) or low-interest loans to help cover down payments and closing costs.

For example:

- A state program gives a $5,000 down payment grant.

- You buy a home for $250,000 with 3% down ($7,500).

- With the grant, your net down payment = $2,500 only.

That’s a big help for new buyers starting out.

📈 Real-Life Example with Calculations

Let’s take a full example to see how it works financially.

Scenario

- Home price = $300,000

- You qualify as a first-time home buyer

- Down payment = 3% ($9,000)

- Loan amount = $291,000

- Interest rate = 6.5% (30 years)

Monthly Principal & Interest:

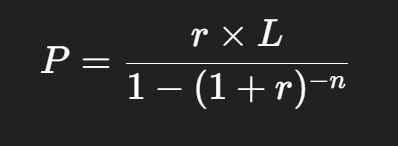

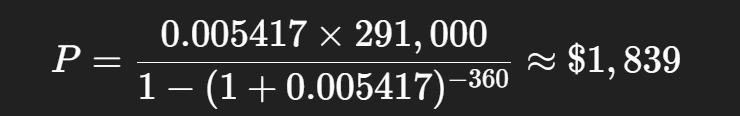

Where:

- r = monthly interest rate (6.5% / 12 = 0.005417)

- L = $291,000

- n = 360 months

So, your monthly principal + interest = $1,839.

Now let’s compare it to a 10% down payment scenario:

| Down Payment | Loan Amount | Monthly Payment (at 6.5%) | Upfront Cash |

| 3% | $291,000 | $1,839 | $9,000 |

| 10% | $270,000 | $1,706 | $30,000 |

✅ Result:

You pay $133 more per month, but save $21,000 upfront.

For many first-time buyers, this trade-off makes homeownership possible years sooner.

🧮 Understanding Closing Costs and Assistance

In addition to the down payment, you’ll also pay closing costs — fees for processing your mortgage, title, and insurance. These usually range between 2% to 5% of your home’s price.

Example:

If your home costs $300,000 and closing costs are 3%,

then total closing costs = $9,000.

But many programs help with this too.

Example with Grant

- Home price: $300,000

- Down payment (3%): $9,000

- Closing costs (3%): $9,000

- Total upfront: $18,000

- Grant assistance: $6,000

✅ Final out-of-pocket = $12,000

That’s a huge relief for first-time buyers.

💳 Credit Score and Income Requirements

Even though programs help first-time buyers, lenders still check financial health.

Here’s what you generally need:

| Loan Type | Minimum Credit Score | Down Payment |

| FHA | 580 | 3.5% |

| Conventional 97 | 620 | 3% |

| VA | 620 | 0% |

| USDA | 640 | 0% |

Besides credit, lenders also look at your Debt-to-Income (DTI) ratio — the portion of your monthly income that goes toward debt payments.

Example:

If you earn $6,000 per month and your total monthly debts are $2,000,

then DTI = (2,000 / 6,000) × 100 = 33%

Most lenders prefer a DTI of 43% or lower.

📚 Education Programs for First-Time Buyers

Many states require a homebuyer education course before you can qualify for assistance.

These programs teach:

- How mortgages work

- Budgeting for homeownership

- Understanding property taxes, insurance, and repairs

Completing such a course can also reduce your mortgage insurance rate or earn you an additional grant.

🏠 First-Time Buyer Example (Full Breakdown)

Let’s do a complete financial breakdown of two buyers — one first-timer and one repeat buyer.

| Category | First-Time Buyer | Repeat Buyer |

| Home Price | $300,000 | $300,000 |

| Down Payment | 3% = $9,000 | 10% = $30,000 |

| Closing Costs (3%) | $9,000 | $9,000 |

| Down Payment Assistance | $5,000 | $0 |

| Total Cash Needed | $13,000 | $39,000 |

| Loan Amount | $291,000 | $270,000 |

| Interest Rate | 6.5% | 6.75% |

| Monthly Payment | $1,839 | $1,860 |

✅ Summary:

The first-time buyer pays $26,000 less upfront and even gets a lower interest rate.

That’s why the first-time buyer classification is so valuable.

📋 Checklist Before You Apply

Here’s a simple step-by-step guide for becoming a first-time home buyer:

- ✅ Check your eligibility (no homeownership in the past 3 years).

- 📊 Review your credit score and fix any issues.

- 💼 Gather financial documents (income proof, tax returns, bank statements).

- 🏦 Research first-time home buyer programs in your state.

- 💰 Calculate down payment and closing costs.

- 🧮 Estimate monthly payments using online calculators.

- 🎓 Complete any required homebuyer education course.

- 💬 Get pre-approved by a lender.

- 🏡 Start your home search within budget.

- ✍️ Close the deal and enjoy your new home!

⚠️ Common Mistakes to Avoid

Even with great programs, first-time buyers often make avoidable errors:

- ❌ Ignoring total monthly costs (taxes, insurance, HOA).

- ❌ Overstretching your budget just to buy sooner.

- ❌ Forgetting maintenance and emergency fund needs.

- ❌ Not comparing multiple loan offers.

- ❌ Skipping pre-approval before house hunting.

Take your time to plan financially — it saves stress later.

📊 Additional Tips for First-Time Home Buyers

- Build credit early. Pay bills on time and reduce card balances.

- Save for hidden costs. Appraisals, inspections, and moving expenses add up.

- Avoid new debt before applying. Don’t buy a car or take a new loan just before your mortgage.

- Shop for lenders. Compare interest rates and assistance programs.

- Think long-term. Buy within your comfort zone — not at your maximum approval limit.

Also Read: The Big Questions Were Receiving from First Home Buyers

🎯 Conclusion: What Is Considered a First Time Home Buyer?

Being a first-time home buyer doesn’t just mean buying your first house ever — it means meeting certain conditions, usually not having owned a primary home in the last three years.

This classification opens the door to lower down payments, government-backed loans, and financial assistance programs that make buying a home far more affordable.

By understanding your eligibility, preparing your finances, and calculating your real costs, you can confidently take your first step toward homeownership.

Remember, the goal isn’t just to buy a house — it’s to buy it wisely and build a stable financial future.