People today are living longer than ever before. Thanks to better healthcare, nutrition, and lifestyle awareness, many individuals are now expecting to live well into their late 80s, 90s, or even past 100. While a long life is a blessing, it also brings a big challenge: how do you make your money last as long as you do?

That’s where financial and retirement planning persons longevity becomes essential. It means planning your savings, investments, and expenses in such a way that even if you live longer than expected, you don’t run out of money.

In this blog, we will explain:

- What longevity risk is

- Why traditional retirement planning is no longer enough

- How to plan financially for a long life

- Real-life scenarios and calculations to understand how much savings you need

- Practical strategies for different types of people

Let’s make it easy and practical.

What Is Longevity Risk?

Longevity risk means the risk of outliving your savings. Most people plan financially assuming they will live till 75 or 80. But what if you live till 95?

That extra 15–20 years without income can completely drain your financial resources if you don’t plan properly.

Think of it like this:

| Age You Plan For | Actual Lifespan | Result |

| Plan till 80 | Live till 80 | Perfect — money lasts fine |

| Plan till 80 | Live till 90 | Money runs out — stress and dependence begin |

Most people don’t realize this risk until it’s too late. So the goal is simple:

✅ Don’t just plan for retirement — plan for long retirement.

How Much Money Do You Need If You Live Longer?

Let’s understand with a simple calculation.

Scenario 1: Planning for 20 Years (Retiring at 65, living till 85)

- Expected annual expense in retirement: $50,000

- Retirement duration: 20 years

- Total money needed (without investment growth):

$50,000 × 20 = $1,000,000

Scenario 2: Planning for 30 Years (Retiring at 65, living till 95)

- Expected annual expense: $50,000

- Retirement duration: 30 years

- Total money needed:

$50,000 × 30 = $1,500,000

👉 Just 10 extra years increases your retirement requirement by $500,000.

Now let’s consider investment returns and inflation.

Calculated Example with Real Return

Let’s assume:

- Investment return during retirement = 5%

- Inflation = 2%

- Real return (after inflation) ≈ 3%

We’ll use a common formula for retirement planning:

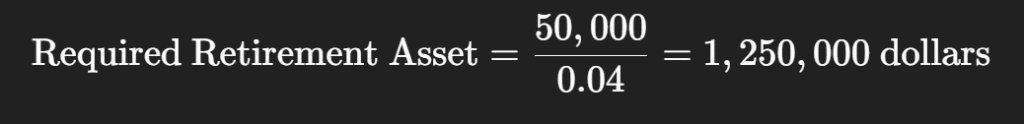

Safe Withdrawal Rate ≈ 4% of total invested retirement funds

This means, if you want $50,000 per year, you need:

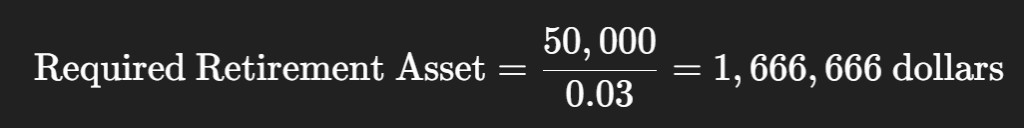

But that only covers around 25–30 years. If you want lifetime protection even till 100, better assume a withdrawal rate of 3%:

✅ So a safe number for longevity-friendly retirement is $1.6 million.

3 Real-Life Planning Scenarios: Financial and Retirement Planning Persons Longevity

1. Early Planner (Age 30, Starts Investing Early)

- Age: 30

- Retirement goal: $1.6 million by age 65

- Investment return: 7% annually

Monthly investment required:

Monthly Investment≈500 dollars

✅ Only $500/month can make you a millionaire by retirement due to compounding.

2. Late Starter (Age 45, Starts Late)

- Age: 45

- Investment target: $1.6 million in 20 years

- Monthly investment required (at 7% return):

Monthly Investment≈1,800 dollars\text{Monthly Investment} ≈ 1,800 \text{ dollars}Monthly Investment≈1,800 dollars

⚠️ Waiting 15 years increases the monthly burden by 260%.

3. Already 60 — Minimal Time Left

- Age: 60

- Retirement in 5 years

- Target: $1.6M

- Already saved: $800,000

- Shortfall: $800,000

Options:

| Strategy | Action |

| Delay retirement | Work till 70 |

| Spend less | Cut expenses from $50k to $35k |

| Buy annuity | Convert lump sum to guaranteed income |

| Part-time income | Freelancing / consulting in retirement |

Even late starters can manage with smart adjustments.

Key Strategies for Longevity-Proof Retirement Planning

✅ 1. Assume You’ll Live Longer Than Expected

If you think you’ll live till 85 — plan till 95. It’s better to die with extra money than to live with none.

✅ 2. Don’t Keep All Money in Safe Instruments

Many retirees shift 100% into fixed deposits, bonds, or cash — which lose value against inflation.

Instead, follow a bucket strategy:

| Bucket Type | Duration Covered | Investment Type |

| Bucket 1 | 1–5 years of expenses | Cash, short-term bonds |

| Bucket 2 | 5–15 years | Balanced funds / index funds |

| Bucket 3 | 15+ years | Equity / growth assets |

This ensures safety + growth balance.

✅ 3. Delay Pension or Social Security If Possible

In countries like the US, delaying Social Security from age 62 to age 70 can increase payouts by up to 77%.

That’s like buying longevity insurance without paying upfront.

✅ 4. Use Annuities or Lifetime Income Plans

Annuities convert your savings into guaranteed income for life. Even if markets crash or you live 40 more years — you still get monthly cash.

Best types to consider:

- Immediate Annuity — income starts right away

- Deferred Income Annuity — pay now, receive after age 80 or 85 (longevity insurance)

✅ 5. Control Withdrawal Rate

Instead of withdrawing randomly, follow structured rules:

| Withdrawal Type | Rule |

| Fixed | Withdraw same amount yearly |

| Percentage | Withdraw 3–4% of remaining balance every year |

| Guardrail | Increase during good years, reduce during bad years |

Flexibility increases longevity of funds.

Final Tips to Secure Financial Life for Longevity

✅ Plan early — compounding is magic

✅ Invest in growing assets — don’t stay too conservative

✅ Expect higher healthcare costs after 75

✅ Keep a separate emergency health fund

✅ Review your plan every year

Also Read: Making the Most of the Instant Asset Write Off: A Guide for Small Businesses

Conclusion

Financial and retirement planning for longevity is not just about saving money — it’s about designing a future where you never feel financially trapped, even at 90 or 100. Whether you are young, mid-career, or already near retirement, the best time to prepare is now.

You only retire once — but it could last 30+ years.

Make sure your money lasts as long as you do.