In Australia, retirement planning is closely tied to superannuation (super), personal savings, investments, and the Age Pension. While many Australians contribute to super through employer contributions (the Superannuation Guarantee), a surprising number make critical mistakes that leave them financially vulnerable in later years.

According to the Association of Superannuation Funds of Australia (ASFA), a comfortable retirement for a couple requires around $690,000 in super (as of 2025 estimates). Yet, many Australians retire with far less. Why? Because they fall into avoidable traps.

In this blog, we’ll explore 4 mistakes that people with poor retirement planning make, show calculations with Australian examples, and explain how to avoid them.

4 Mistakes That People With Poor Retirement Planning Make

Mistake 1: Starting Too Late and Underestimating Compounding

Why it matters in Australia

Many Australians delay voluntary super contributions, relying only on compulsory employer contributions (currently 11.5% of salary in 2025, legislated to reach 12% by 2026). While compulsory super helps, starting additional contributions late in life means you miss decades of compounding growth.

Example Calculation

Let’s compare two Australians:

- Sarah (age 30) earns $70,000 per year. She salary-sacrifices an extra $200 per month into super on top of employer contributions.

- James (age 40) also earns $70,000 but starts the same $200/month extra contribution 10 years later.

- Assume super grows at 6% p.a. after fees and taxes until age 67.

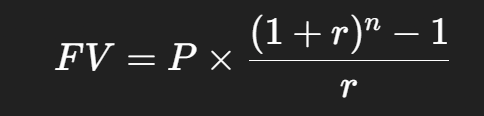

Using the future value of an annuity formula:

Where:

- PPP = $200

- rrr = 0.005 (0.5% monthly return)

- nnn = total months

For Sarah: n=37×12=444

For James: n=27×12=324

- Sarah’s balance = $200 × [((1.005)^444 – 1) / 0.005] ≈ $285,000

- James’s balance = $200 × [((1.005)^324 – 1) / 0.005] ≈ $153,000

That’s a difference of over $130,000, simply because Sarah started 10 years earlier.

How to avoid this mistake

- Begin voluntary contributions (salary sacrifice or personal deductible contributions) as early as possible.

- Automate contributions so they’re consistent.

- Use compound growth calculators provided by ASIC’s Moneysmart website to project outcomes.

Mistake 2: Ignoring Inflation and Future Costs of Living

Why it matters in Australia

Many Australians underestimate how much retirement will cost. Inflation erodes the value of money, meaning $50,000 today won’t buy the same lifestyle in 20 years. This is particularly important for healthcare, which often rises faster than general inflation.

Example Calculation

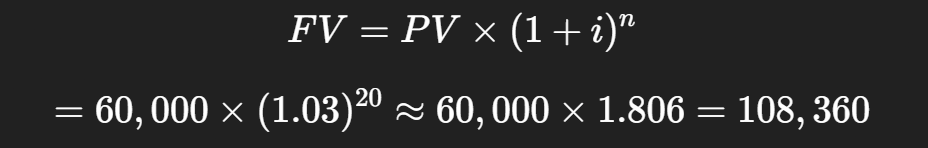

Suppose you estimate you’ll need $60,000 per year in retirement (today’s value).

If average inflation is 3% per year, what happens over 20 years?

So you’ll actually need $108,360 per year in 20 years to maintain the same lifestyle.

Now multiply that by 25 years of retirement:

108,360×25=2.7 million

This shows why ignoring inflation leads to underfunding.

How to avoid this mistake

- Always factor in inflation (2.5–3% average, but allow for higher healthcare inflation).

- Invest in growth assets (like Australian shares, international equities, property trusts) within super, as they typically outpace inflation over long periods.

- Regularly review your retirement projections.

Mistake 3: Poor Investment Mix and Lack of Diversification

Why it matters in Australia

Super funds offer investment options ranging from “conservative” to “high growth.” Many Australians either:

- Stay in the default option without reviewing it,

- Invest too conservatively too early, or

- Go too aggressively near retirement.

Both extremes are dangerous. Too conservative = inflation eats away returns. Too risky = market downturns just before retirement can slash savings.

Example Calculation

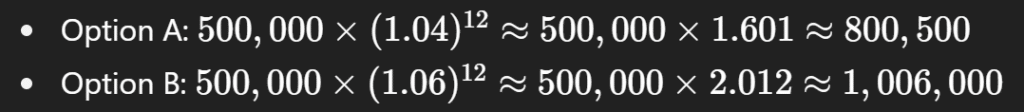

Imagine you have $500,000 in super at age 55 with 12 years until retirement.

- Option A (Conservative Fund): Expected return 4% p.a.

- Option B (Balanced Fund): Expected return 6% p.a.

Future value calculation:

That’s a difference of $205,000 over 12 years.

How to avoid this mistake

- Review your super’s investment option regularly.

- Diversify across asset classes: shares, bonds, property, infrastructure.

- Use a “glide path” approach: higher growth in early/mid career, shifting gradually towards balanced/conservative as retirement nears.

- Seek professional advice on risk tolerance.

Mistake 4: No Withdrawal Strategy and Ignoring Tax Rules

Why it matters in Australia

Retirement isn’t just about building wealth; it’s also about drawing it down wisely. Poor withdrawal planning can cause people to run out of money too early or pay unnecessary tax.

Australia also has specific rules:

- At age 60, most super withdrawals become tax-free if you’re retired.

- The Age Pension is means-tested, so large withdrawals or assets can reduce your entitlement.

Example Calculation

Suppose you retire at 67 with $700,000 in super.

- If you withdraw $70,000 per year (10%), your savings may run out in ~12 years if returns are modest.

- If you withdraw a more sustainable 4% ($28,000 per year) and let the rest keep earning 6% returns, your money can last well beyond 25 years.

This shows why a proper drawdown strategy matters.

How to avoid this mistake

- Follow a safe withdrawal rate (often 3–4% of balance per year, adjusted for inflation).

- Combine super drawdowns with Age Pension eligibility to stretch resources.

- Consider account-based pensions within super, which provide regular income and remain tax-free after 60.

- Avoid large lump sum withdrawals unless necessary.

Additional Tips for Australians

- Super Contribution Caps: Concessional contributions (before-tax, e.g. salary sacrifice) are capped at $30,000 per year (2025). Going over can trigger extra tax.

- Government Co-contributions: If your income is below ~$45,000, the government may top up your personal contributions by up to $500.

- Spouse Contributions: Tax offset available if contributing to a low-income spouse’s super.

- Downsizer Contribution: Over 55s can contribute up to $300,000 from selling the family home into super (outside normal caps).

Also Check: Retirement Planning Tips Secure Comfortable Future

Summary Table

| Mistake | Why It’s Harmful | Example Outcome | Fix |

| Starting Too Late | Misses compounding | $285k vs $153k extra super | Start voluntary contributions early |

| Ignoring Inflation | Underestimates costs | $60k today = $108k in 20 yrs | Plan with inflation factored in |

| Poor Diversification | Too risky or too safe | $1m vs $800k at retirement | Diversify and review super option |

| No Withdrawal Strategy | Money runs out early | $70k p.a. lasts 12 yrs vs 4% rule lasting 25+ yrs | Plan sustainable withdrawals |

Conclusion

Retirement should be a time of security, not stress. But too many Australians sabotage their future by starting late, ignoring inflation, investing poorly, or withdrawing without a plan.

The good news? Each mistake is avoidable with awareness, discipline, and the right strategy. Start early, factor in inflation, diversify smartly, and plan your withdrawals with tax rules in mind.

By addressing these four mistakes, Australians can maximise their super, enjoy financial independence, and truly make the most of their golden years.