Financial wellness means more than just having money in your bank account. It’s about how you manage your earnings, savings, debt, and long-term goals. In the United States, millions of people struggle with financial stress because they don’t follow simple habits like budgeting, saving for emergencies, or planning for retirement.

The good news is that financial wellness can be achieved with practical, step-by-step actions. In this blog, we’ll discuss 5 practical ways to shape your financial wellness—each explained with real-life examples and easy calculations. By following these, you’ll not only reduce financial stress but also secure your future.

5 Practical Ways to Shape Your Financial Wellness

1. Track Your Money and Create a Realistic Budget

Why It Matters

The first step to financial wellness is understanding where your money goes. Many Americans earn well but still live paycheck-to-paycheck because they don’t track their income and expenses.

How to Do It

- Write down all income sources (salary, freelance work, dividends).

- Track expenses: fixed (rent, insurance), variable (groceries, fuel), and discretionary (entertainment, shopping).

- Compare spending with income to identify gaps or waste.

- Use tools like Mint, YNAB, or a simple spreadsheet.

Example Calculation

Suppose John earns $4,000/month after taxes. Here’s his monthly spending:

| Category | Amount |

| Rent & Utilities | $1,200 |

| Food & Groceries | $600 |

| Transport | $300 |

| Entertainment | $400 |

| Subscriptions | $100 |

| Debt Payment | $600 |

| Savings | $200 |

| Total | $3,400 |

John has $600 left unaccounted for. Without tracking, he might waste it on impulse spending. By redirecting just half of it ($300) toward debt or savings, he can improve his financial position quickly.

Tip: Follow the 50/30/20 rule: 50% needs, 30% wants, 20% savings/debt repayment.

2. Build an Emergency Fund and Pay Down High-Interest Debt

Emergency Fund

Life is unpredictable—job loss, medical bills, car repairs. An emergency fund protects you from falling into debt when unexpected expenses occur.

- Start with $1,000 as a short-term goal.

- Build up to 3–6 months of essential expenses.

If your monthly expenses are $3,000, aim for $9,000–$18,000 as a safety net.

High-Interest Debt

Credit card debt and payday loans can trap you in a cycle of interest payments. Paying these off quickly is crucial.

Debt Payoff Methods

- Snowball Method – Pay smallest debt first for quick wins.

- Avalanche Method – Pay highest interest debt first to save money.

Example Calculation

Emily has:

- Credit Card: $5,000 at 20% APR, min payment $150

- Personal Loan: $2,000 at 10% APR, min payment $80

If she uses the Avalanche Method, she pays $550/month ($150 min + $400 extra) on her credit card:

- Monthly interest = (20% ÷ 12) × $5,000 = $83.33

- Payment = $550 – $83.33 = $466.67 toward principal

- After 1 month, balance = $5,000 – $466.67 = $4,533.33

By consistently paying, Emily can clear her card in under a year while also saving $100/month for emergencies.

3. Automate Your Savings and Payments

Why Automation Works

Humans are emotional spenders. Automation helps avoid missed payments, late fees, and inconsistent savings. It ensures you “pay yourself first.”

What to Automate

- Bill payments (rent, utilities, loans)

- Emergency fund transfers ($100–$300 monthly)

- Retirement contributions (401(k), Roth IRA)

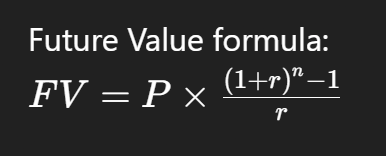

Example: Compound Growth

If you invest $300/month in a retirement account with a 7% annual return, compounded monthly:

Where:

- P = $300

- r = 0.07/12 = 0.005833

- n = 30 × 12 = 360

After 30 years:

FV ≈ $368,426

That’s the power of automation and compounding—small amounts grow into a significant nest egg.

4. Plan for Retirement Early and Increase Contributions

Why It’s Important

Social Security alone may not cover your retirement needs. Building retirement savings ensures financial independence in later years.

What to Do

- Contribute to 401(k) or 403(b) if your employer offers one.

- Always grab the employer match (free money).

- Open an IRA (Traditional or Roth) for extra savings.

- Increase contributions by 1–2% each year.

Example: Employer Match

Sarah earns $60,000/year.

- She contributes 6% = $3,600/year.

- Employer matches 50% of up to 6% = $1,800/year.

- Total annual contribution = $5,400.

If invested at 7% return for 30 years:

FV ≈ $5,400 × ((1.07^30 – 1) / 0.07) ≈ $547,000.

This shows how consistent contributions plus employer match can create wealth over time.

5. Boost Your Income and Invest in Education

Why Income Growth Matters

Cutting expenses has limits, but increasing income expands your financial capacity. Extra money can accelerate debt payoff, savings, and investments.

How to Boost Income

- Freelancing (graphic design, writing, tutoring)

- Part-time work or side hustles

- Asking for a raise or promotion

- Upskilling (courses, certifications)

- Passive income (dividends, rental properties)

Example: Side Hustle Impact

If Alex earns an extra $500/month from freelance work and invests it at 7% return:

- Annual = $6,000

- Over 20 years → FV ≈ $6,000 × ((1.07^20 – 1) / 0.07) ≈ $245,000.

That side hustle could cover his child’s college tuition or support early retirement.

A 3-Year Roadmap to Financial Wellness

Here’s how you can combine all 5 ways step by step:

| Year | Action Plan | Expected Outcome |

| Year 1 | Track spending, build $1,000 emergency fund, pay off one debt | Better control, fewer financial shocks |

| Year 2 | Automate $300/month savings, contribute 6% to 401(k), clear high-interest debt | Growing investments, less debt stress |

| Year 3 | Grow emergency fund to 3 months, increase retirement contribution to 10%, start side hustle | Financial stability and growth |

Common Pitfalls to Avoid

- Lifestyle Creep: Spending more as income rises instead of saving.

- Ignoring Interest Rates: High-interest debt can cancel out investment gains.

- No Insurance: Medical or car accidents can wipe out savings.

- Not Reviewing Plans: Adjust yearly as your income and goals change.

Conclusion

Financial wellness doesn’t happen overnight, but with consistent action, it becomes achievable. By tracking money, building emergency savings, paying down debt, automating contributions, planning for retirement, and boosting income, you can secure your financial future.

Remember, even small steps—like saving $100/month or paying an extra $50 toward debt—make a big difference over time. Start today, and your future self will thank you.