Everyone dreams of being financially secure, but few truly understand the key concepts build wealth successfully. Wealth is not built overnight; it requires discipline, knowledge, and consistent action. In the U.S., opportunities exist through jobs, businesses, investments, and tax-advantaged accounts. However, without clear strategies, even a high income can disappear.

This blog will explain the 10 most important wealth-building concepts, with real-life examples and simple calculations so you can see how to apply them in your own financial journey.

Concepts Build Wealth Successfully: 10 Points

1. Earn Well and Diversify Income

The first step is to increase income and create multiple income streams. Your salary or business is important, but extra income makes a big difference.

How to Do It

- Upskill or negotiate a raise at your job.

- Try freelancing, online courses, or consulting.

- Create passive income through investments, rental property, or royalties.

Example Calculation

If you earn $60,000/year and add a side hustle of $5,000, you invest $3,000 of that extra income annually at 7% return:

In 20 years, you’ll have $11,610 extra wealth — just from redirecting side hustle money.

2. Set Clear Goals and Build a Plan

Wealth doesn’t just happen — you need clear financial goals.

Example Goals

- Short term: build a $20,000 emergency fund.

- Mid term: save for a $300,000 home in 5 years.

- Long term: retire at 65 with $1 million.

Example Calculation

If you start with $50,000 at age 30 and invest $10,000/year until 65 at 7% growth:

- Current $50,000 grows to ≈ $533,850.

- Annual contributions grow to ≈ $1.38 million.

- Total ≈ $1.9 million.

By setting and following a plan, you not only meet but exceed your retirement goal.

3. Save and Build an Emergency Fund

An emergency fund keeps you safe from surprises like medical bills or job loss.

Rule of Thumb

Save 3–6 months of living expenses.

Example Calculation

If monthly expenses = $3,000, then 6 months = $18,000.

Saving $1,500/month → full fund in 12 months.

This prevents you from using credit cards or loans in emergencies.

4. Invest Wisely and Diversify

Savings protect you, but investments grow wealth. U.S. investors should diversify into stocks, bonds, ETFs, and real estate.

Example Portfolio

- 40% U.S. stocks = $40,000

- 20% International = $20,000

- 30% Bonds = $30,000

- 10% Real estate = $10,000

If U.S. stocks earn 8%, bonds 3%, real estate 6%, portfolio return = 6.7% average annually.

Diversification reduces risk while keeping returns strong.

5. Harness Compound Interest

Compound interest is the most powerful wealth concept.

Example

At 25, you invest $5,000/year for 10 years (stop at 35) and let it grow until 65 at 7%.

- Each deposit grows differently, but total ≈ $120,000–$150,000.

If you waited until 35 and invested $5,000/year until 65, you’d contribute $150,000 but end with less wealth than the early starter.

Lesson: Start early!

6. Minimize Taxes

Taxes can eat into wealth, so use legal ways to reduce them.

Tips for U.S. Audience

- Max out 401(k) (pretax) and Roth IRA (tax-free withdrawals).

- Hold assets longer to get long-term capital gains rates (15% instead of 24%).

- Use tax-loss harvesting to offset gains.

Example

If you sell stock with $10,000 gain:

- Held < 1 year → taxed at 24% = $2,400 tax.

- Held > 1 year → taxed at 15% = $1,500 tax.

That’s $900 saved, just by holding longer.

7. Manage Debt and Credit

Wealth disappears if you’re stuck in high-interest debt.

Good vs Bad Debt

- Good: low-interest mortgage, student loans.

- Bad: credit cards (18–25% APR).

Example

$5,000 credit card at 20% APR:

- Paying only minimum may take years and cost $thousands.

- Paying $500/month → debt cleared in 11 months.

That’s like earning a 20% guaranteed return.

Also, good credit saves money. A higher FICO score = lower mortgage interest rate, saving tens of thousands over 30 years.

8. Protect Assets and Reduce Risks

Wealth without protection can vanish.

How to Protect

- Health, disability, life, home, and auto insurance.

- Estate planning: will, trust.

- Diversify investments.

Example

No disability insurance → 6-month job loss = $30,000 lost income. Insurance might cost $600/year but protects your family’s stability.

9. Use Leverage and Equity

True wealth often comes from equity ownership (stocks, businesses, real estate) and smart leverage.

Example

- Buy a rental property with 20% down on $200,000 house ($40,000). If home rises to $250,000, equity grows $50,000. That’s a 125% gain on initial investment.

- Create digital product costing $2,000. If 200 people buy at $100 each, revenue = $20,000.

Leverage and ownership multiply returns compared to trading only your time for money.

10. Mindset and Discipline

The most overlooked concept is mindset. Wealth requires patience, consistency, and delayed gratification.

Example

If you spend $200/month on extras (coffee, gadgets) = $2,400/year.

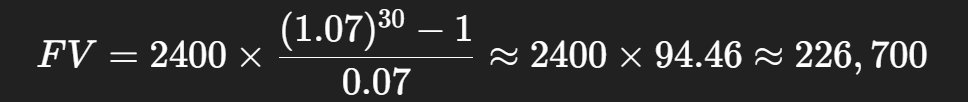

Investing that at 7% for 30 years:

That’s nearly $227,000 from small sacrifices.

Also Read: 5 Ways How to Generate Passive Income in Australia

Putting It Together: A Sample Plan

Meet Sarah, 30 years old, income $70,000/year, debt $10,000, wants $1.5M by 65.

| Step | Action | Timeline/Amount |

| Emergency Fund | $24,000 (6 months) | 12 months saving $2,000/month |

| Debt Payoff | $10,000 credit card | 13 months at $800/month |

| Savings | 20% income ($14,000/year) | Auto transfer |

| Investing | $10,000/year at 7% | ≈ $1.5M at retirement |

| Protection | Health, life, disability insurance | $1,000/year |

| Tax Planning | Max Roth IRA + 401(k) | Saves $1,500/year |

| Review | Annual rebalance | Continuous |

Sarah ends up with secure, diversified wealth and peace of mind.

Common Pitfalls to Avoid

- Over-borrowing and ignoring high-interest debt.

- Procrastinating investments (“I’ll start next year”).

- Trying to time the stock market.

- Neglecting insurance.

- Overlooking taxes and fees.

Conclusion

Building wealth successfully is not about luck. It is about understanding and applying core concepts consistently: earning more, setting goals, saving, investing, compounding, reducing taxes, avoiding bad debt, protecting assets, leveraging equity, and maintaining discipline.

For U.S. readers, these concepts — when applied early and steadily — can lead to financial independence and the ability to live life on your own terms.

Wealth is not just about money; it’s about freedom, security, and choices. Start applying these concepts today, and your future self will thank you.