Parents dream of securing their child’s future, and one of the best ways to do this is through early financial planning. In countries like Australia, superannuation is the standard retirement system. In the U.S., there isn’t a direct “superannuation” account, but we do have several investment and savings accounts for children that serve the same purpose.

This blog explains how it works contributing to your childs superannuation, or in U.S. terms, contributing to their retirement and investment accounts. We’ll break down the benefits, account types, tax advantages, legal rules, and even show you step-by-step calculations so you can see the long-term impact of starting early.

Why Contribute to Your Child’s “Superannuation” Early?

Contributing to your child’s long-term savings isn’t just about money—it’s about giving them a head start in life.

Key Benefits

- Compound Interest – Small contributions now grow into large sums later.

- Tax Advantages – Certain accounts let investments grow tax-free.

- Financial Habits – Kids learn about money early by watching parents save.

- Reduced Stress – Your child enters adulthood with security, not debt.

U.S. Alternatives to Superannuation

In the U.S., these are the most common accounts parents use when “contributing to superannuation” for kids.

| Account Type | Purpose | Key Features | Tax Benefits |

| Roth IRA for Minors | Retirement | Must have earned income; parent as custodian | Tax-free growth & withdrawals |

| Custodial Accounts (UGMA/UTMA) | General investment | Parent manages till child turns 18/21 | Some tax benefits; child owns at majority |

| 529 College Plan | Education | State-sponsored education savings | Tax-free for qualified education expenses |

Step-by-Step: How It Works Contributing to Your Childs Superannuation

- Pick the Goal – Retirement, education, or general savings.

- Choose the Account Type – Roth IRA (retirement), 529 plan (education), custodial (general savings).

- Open the Account – With a bank, brokerage, or state program.

- Start Contributing – Lump sum or small monthly deposits.

- Invest Wisely – Stocks, bonds, index funds depending on age.

- Rebalance Over Time – Adjust as your child grows older.

Rules You Should Know

- Roth IRA for Minors – Child must have earned income (babysitting, part-time job, self-employment). Contribution limited to lesser of child’s income or annual Roth limit.

- Custodial Accounts (UGMA/UTMA) – Parent controls until age 18/21, then child takes ownership. No contribution cap, but gift tax rules apply.

- 529 Plans – Must be used for qualified education expenses. If not, withdrawals may be taxed and penalized.

How Small Contributions Grow: Examples & Calculations

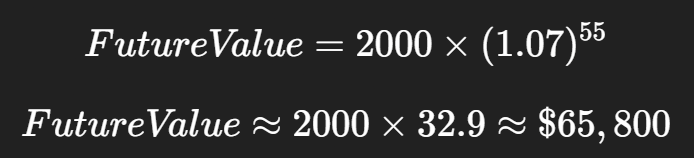

Example 1: One-Time Contribution at Age 10

- Parent invests $2,000 into a Roth IRA when child is 10.

- Assume 7% annual growth, left untouched until age 65.

👉 That’s turning just $2,000 into $65,800.

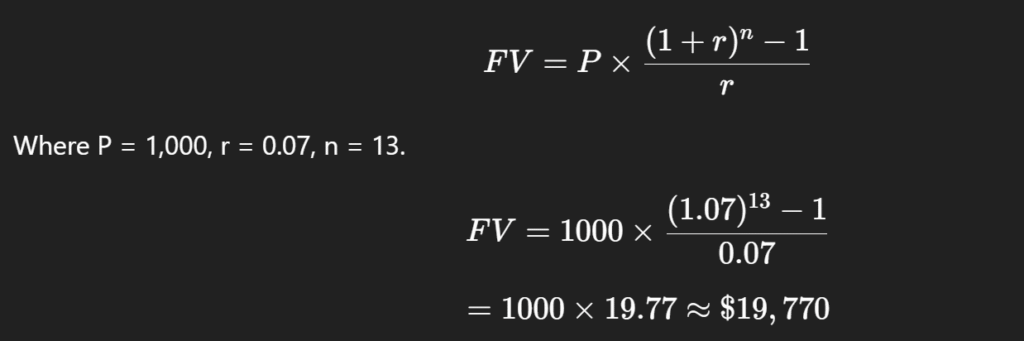

Example 2: Annual Contributions to Custodial Account

- Child age: 5

- Parent contributes $1,000 per year for 13 years until child is 18.

- Growth: 7% annually.

Formula for future value of series:

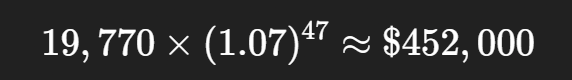

👉 At age 18, child has $19,770. If left invested until 65:

A little every year can create nearly half a million dollars.

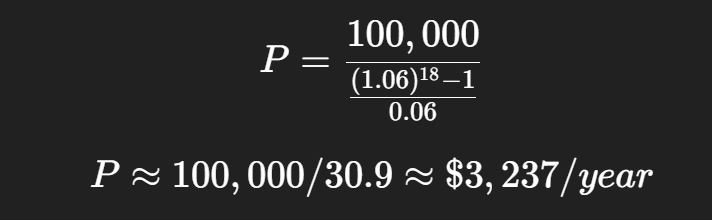

Example 3: 529 Plan for Education

- Goal: $100,000 in 18 years for college.

- Growth: 6% annually.

Annual contribution needed:

👉 You need to invest about $3,237 per year for 18 years to hit $100,000.

Pros and Cons of Each Option

| Option | Pros | Cons |

| Roth IRA for Minors | Tax-free retirement growth | Must have earned income |

| Custodial Account | Flexible investments | Child gets full control at 18/21 |

| 529 Plan | Tax-free for education | Penalties for non-education use |

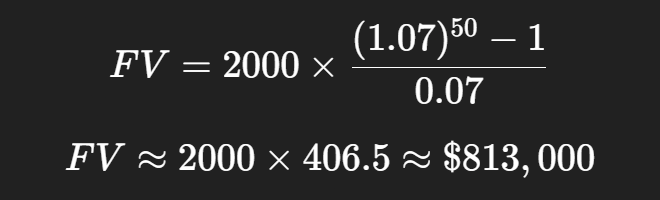

Strategic Combination: Retirement + Education

Smart parents combine strategies. For example:

- 529 Plan: Save ~$2,600/year for education.

- Roth IRA (Minor): Once child works, contribute $2,000/year.

At 7% growth, consistent Roth contributions of $2,000/year from age 15–65 =

👉 Your child retires with over $800,000, plus has college costs covered.

Also Check: Benefits of Superannuation You Need to Know

Conclusion

Now you know how it works contributing to your childs superannuation—whether through a Roth IRA for minors, custodial accounts, or 529 education plans. The real power lies in starting early and letting compound interest do the heavy lifting.

A few thousand dollars invested in childhood can grow into hundreds of thousands—or even millions—by retirement. By combining the right account types and sticking to a plan, you’re not just giving your child money—you’re giving them security, freedom, and financial confidence for life.