Buying a home is a dream for many people, but when you are already paying rent, saving for a new home can feel like an impossible task. Rent consumes a big part of your monthly income, leaving little room to put money aside. On top of that, rising living costs and everyday expenses make the goal of homeownership look far away.

But here’s the good news: with the right strategies, discipline, and planning, you can save money for a new home while renting. Whether you’re saving for a small starter home or your dream house, the key is to set clear financial goals, cut unnecessary spending, and make your money work smarter.

In this blog, we’ll go step by step to understand exactly how to save money for a new home while renting. You’ll find practical tips, real-life examples, and even calculated scenarios to help you visualize how much you can save and how soon you can reach your homeownership goal.

How to Save Money for a New Home While Renting?

Set Clear Goals: Estimating How Much You Need

The first step is to know how much money you need to save before buying a house. This includes the down payment, closing costs, and some extra for moving or emergency expenses.

- Down payment: Usually ranges from 3% to 20% of the home’s price.

- Closing costs: Around 2% to 5% of the home price.

- Emergency buffer: At least 3 months of expenses is recommended.

👉 Example:

If the home you want costs $250,000, here’s how the numbers work out:

- 10% down payment = $25,000

- Closing costs (3%) = $7,500

- Emergency buffer (say $6,000 for three months) = $6,000

Total you need: $38,500

Once you know this number, you can divide it by the number of months you plan to save. For instance, if you want to buy in 3 years (36 months), you’ll need to save about $1,070 per month.

Knowing the exact target helps you stay motivated and makes the savings plan realistic.

Track and Optimize Your Budget

When you’re renting, budgeting becomes your most powerful tool. Without tracking, money often “disappears” on small, unnecessary expenses.

Use the 50/30/20 rule as a base:

- 50% for needs (rent, food, bills)

- 30% for wants (entertainment, dining, subscriptions)

- 20% for savings and debt repayment

But when saving for a home, you can adjust to:

- 50% needs

- 20% wants

- 30% savings

👉 Example (Monthly income = $4,000):

- Needs (50%) = $2,000 (rent, utilities, groceries)

- Wants (20%) = $800 (shopping, Netflix, eating out)

- Savings (30%) = $1,200 (goes directly into home fund)

By cutting “wants” down by $400, you’ll have an extra $4,800 saved in just one year!

Pro tip: Use budgeting apps like Mint, YNAB, or even a simple Excel sheet. This visibility keeps you accountable.

Reduce Rent Burden Strategically

Your rent is probably your largest monthly expense. Reducing it will have the biggest impact on your savings.

Ways to reduce rent costs

- Move to a smaller apartment – Downsizing from a $1,800 apartment to a $1,400 one saves you $400/month or $4,800/year.

- Get a roommate – If your rent is $1,600, splitting it with a roommate reduces your share to $800. That’s a saving of $800/month or $9,600/year.

- Relocate slightly outside the city – Sometimes living 15–20 minutes away from the city center can cut rent by 20–30%.

👉 Example:

If you save $500/month on rent and direct it to your home savings account, in 3 years you’ll have $18,000 saved – almost half of a $40,000 goal.

Cut Discretionary Spending & Sell Unwanted Items

Many renters spend hundreds on things they don’t even use. If you redirect those funds, your savings will grow much faster.

Cut these expenses

- Subscriptions: Netflix, Hulu, gym memberships you rarely use. Saving just $50/month = $600/year.

- Dining out: If you cut dining from $300/month to $150/month, you’ll save $1,800/year.

- Impulse shopping: Set a 24-hour rule before buying anything non-essential.

Sell unwanted items

Decluttering not only frees up space but also puts cash in your pocket. Sell old furniture, gadgets, clothes, or unused items online. Even if you make $2,000 over a year, that’s two months of rent saved.

Automate Savings & Choose the Right Accounts

Saving works best when it happens without thinking about it.

Steps to make savings automatic

- Open a separate high-yield savings account (HYSA) just for your home fund.

- Set automatic transfers every payday – for example, $500 goes straight into this account.

- Use round-up apps – every purchase is rounded up and extra cents are deposited into savings.

- Deposit windfalls – tax refunds, bonuses, or gifts should go directly into your house fund.

👉 Example:

If you earn a $2,000 annual bonus and add it to your $1,000/month savings, that’s an extra $38,000 in just 3 years (instead of $36,000).

Plus, high-yield accounts grow your savings faster through interest.

Increase Income: Side Hustles & Windfalls

If your expenses are already tight, the only way to save more is to earn more.

Side hustle ideas

- Freelancing (writing, design, coding)

- Driving for Uber/Lyft

- Food delivery

- Online tutoring

- Weekend part-time jobs

👉 Example:

If you earn an extra $300/month through freelancing:

- $300 × 12 months = $3,600/year

- Over 3 years = $10,800 extra toward your house fund.

Combined with budgeting and reduced rent, this can push you closer to your goal much faster.

Explore Programs & Innovative Options

Don’t ignore financial assistance options designed for renters aspiring to buy homes.

Programs worth exploring

- First-time homebuyer programs – lower down payments (as low as 3%).

- Employer programs – some companies offer down-payment assistance.

- Rent-to-own agreements – part of your rent goes toward homeownership.

- Cash-back renting programs like “Roots” or “Gravy” – they give rebates or credits toward your future down payment.

👉 Example: If you rent through a program that gives 3% back annually on $1,500 rent, you’ll earn $540 per year. In 3 years, that’s $1,620 extra saved.

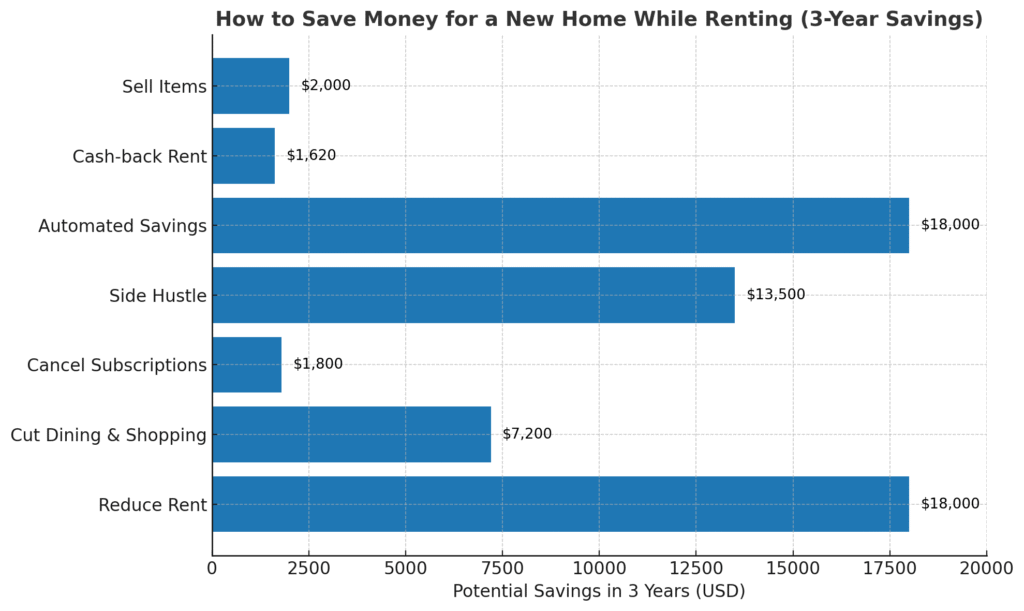

✅ Quick Summary Table: How to Save Money for a New Home While Renting

| Strategy | Example Savings Per Month | Annual Savings | 3-Year Total |

| Reduce Rent (smaller place/roommate) | $300 – $800 | $3,600 – $9,600 | $10,800 – $28,800 |

| Cut Dining & Shopping | $200 | $2,400 | $7,200 |

| Cancel Subscriptions | $50 | $600 | $1,800 |

| Side Hustle (freelance/part-time) | $250 – $500 | $3,000 – $6,000 | $9,000 – $18,000 |

| Automated Savings Plan | $500 | $6,000 | $18,000 |

| Cash-back Rent Programs | $45 | $540 | $1,620 |

| Sell Unwanted Items (one-time) | – | ~$2,000 | ~$2,000 |

💡 Total Potential Savings in 3 Years: $50,000+ (depending on your income and lifestyle).

Example Scenario: From Renting to Saving for a Home

Let’s combine all strategies into one realistic example.

Alex’s Situation:

- Income: $4,000/month

- Rent: $1,500/month

- Goal: $36,000 in 3 years

Plan:

- Cuts rent by $300 → saves $3,600/year

- Reduces dining/shopping by $200/month → saves $2,400/year

- Side hustle adds $250/month → saves $3,000/year

- Automates $500/month savings → saves $6,000/year

Total annual savings: $15,000

In just 3 years, Alex will have $45,000 saved, exceeding the $36,000 goal.

This example shows that small changes across different areas can quickly add up.

Conclusion

Saving for a new home while renting is definitely challenging, but it is far from impossible. By setting a clear savings target, cutting unnecessary costs, reducing rent where possible, and increasing your income through side hustles, you can steadily build the amount you need for a down payment.

Remember, consistency matters more than speed. Even if you can only save $200 a month, that’s $2,400 a year – and it adds up over time. The earlier you start, the sooner you’ll be able to step into your own home.

So, take control of your budget, open a dedicated savings account, and start today. Your future home is closer than you think!