Your 20s are a unique stage in life. You may have just completed your studies, started your career, and begun earning your first real income. At the same time, this decade is often filled with lifestyle temptations—gadgets, vacations, restaurants, and social spending.

But here’s the secret: every rupee (or dollar) you save in your 20s is worth more than the same rupee saved later. Why? Because of compound interest—the ability of money to grow by earning returns on returns over time.

If you adopt the right habits now, how you can build wealth in your 20s and retire early—maybe in your 40s or even 30s. This blog explains every detail with step-by-step strategies, real-world examples, and simple calculations so you know exactly how to do it.

How You Can Build Wealth in Your 20s and Retire Early

Start Early: The Power of Compounding in Your 20s

Compounding is your most powerful wealth-building ally.

- What is it?

It’s when the interest you earn is reinvested and starts earning interest itself. Over time, the growth becomes exponential. - Simple Example (Indian context):

- Invest ₹2,000 per month in a mutual fund at 12% annual return.

- After 20 years → you’ll have ₹1 crore+.

- If you wait until 30 and invest the same amount → at 40, you’ll only have around ₹30 lakh.

- Invest ₹2,000 per month in a mutual fund at 12% annual return.

- US Example:

- Invest $300 per month from age 22 at 8% return.

- By age 60, you’ll have over $1 million.

- Start at 32 instead → you’ll only have about $440,000.

- Invest $300 per month from age 22 at 8% return.

👉 Lesson: Time is more valuable than money. The earlier you begin, the less you need to invest to achieve wealth.

Smart Saving Habits to Build Wealth Fast

Saving in your 20s is about creating habits that last a lifetime.

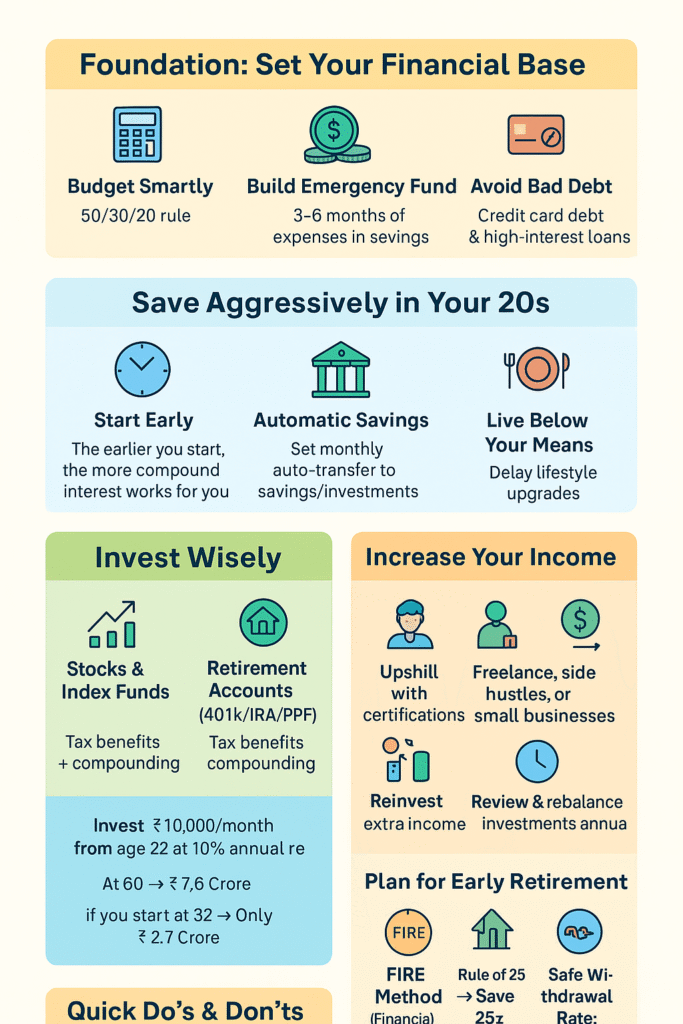

- Pay Yourself First

Treat savings like rent or bills—non-negotiable. Automate transfers into savings or investment accounts on payday. - Use the 50/30/20 Rule

- 50% → Needs (rent, food, transport)

- 30% → Wants (entertainment, travel)

- 20% → Savings/Investments

- 50% → Needs (rent, food, transport)

- Example: If your salary is ₹50,000/month → save at least ₹10,000.

- Increase Savings with Income Growth

Every time your salary rises, increase your savings percentage. For example, if you get a 10% hike, increase savings by 5%. - Avoid Lifestyle Inflation

Don’t rush to upgrade cars, gadgets, or apartments as soon as income increases. Keep expenses stable and let savings rise.

👉 These habits keep you financially disciplined while still enjoying life.

Investing Strategies to Retire Early

Saving money is just step one—investing is how you grow wealth.

- Stock Market (Equities & ETFs)

- Historically give 8–12% returns annually.

- Start with low-cost index funds or ETFs like Nifty 50 (India) or S&P 500 (US).

- Historically give 8–12% returns annually.

- Mutual Funds / SIPs

- Systematic Investment Plans let you invest monthly, creating discipline.

- Example: ₹5,000/month at 12% → ₹3 crore in 30 years.

- Systematic Investment Plans let you invest monthly, creating discipline.

- Retirement Accounts (Tax-Advantaged)

- India: PPF, EPF, NPS.

- US: 401(k), Roth IRA.

- These accounts save tax today and grow your wealth tax-free.

- India: PPF, EPF, NPS.

- Diversification

Don’t put all money in one asset. Spread across stocks, bonds, real estate, and even gold.

👉 Investing wisely makes early retirement not just a dream but a real possibility.

FIRE Movement: A Blueprint for Early Retirement

FIRE = Financial Independence, Retire Early.

It’s a global trend where people save aggressively (often 50–70% of their income), invest it, and aim to retire decades before 60.

- How It Works:

- Live frugally.

- Save as much as possible.

- Invest aggressively in equities and assets.

- Build a portfolio large enough to cover your annual expenses forever.

- Live frugally.

- Example:

If you spend ₹6 lakh/year → You’ll need ₹1.5 crore invested (based on the 4% rule).

Once you reach this corpus, you can retire and live on investment returns.

👉 FIRE is not about never working again—it’s about financial freedom. You can choose passion projects, part-time work, or even travel full-time without money stress.

Avoiding Debt and Building an Emergency Fund

Your journey can derail if you’re buried in debt.

- Pay Off High-Interest Debt First

- Credit cards, payday loans, or personal loans usually charge 15–30% interest.

- Paying them off is like earning a guaranteed return.

- Credit cards, payday loans, or personal loans usually charge 15–30% interest.

- Build an Emergency Fund

- Keep 3–6 months of expenses in a savings account.

- This protects you from job loss, medical bills, or emergencies.

- Keep 3–6 months of expenses in a savings account.

- Use Good Debt Smartly

- Home loans or education loans can build assets or skills.

- But avoid borrowing for cars, gadgets, or lifestyle.

- Home loans or education loans can build assets or skills.

👉 Staying debt-free and prepared keeps your wealth safe.

Side Hustles and Passive Income Ideas in Your 20s

Earning more is just as important as saving more.

- Side Hustles

- Freelancing (writing, design, coding).

- Tutoring, online courses.

- Selling products online.

- Freelancing (writing, design, coding).

- Passive Income

- Dividend-paying stocks.

- Real estate (rentals, REITs).

- Blogging, YouTube, or digital products.

- Dividend-paying stocks.

Example:

A ₹10,000/month side hustle invested at 10% returns grows into ₹76 lakh in 20 years.

👉 Side hustles speed up your savings and bring financial freedom earlier.

How Much Do You Really Need to Retire Early?

The 4% Rule helps calculate your retirement target:

- Multiply your annual expenses × 25.

- If you spend ₹8 lakh/year → you need ₹2 crore to retire early.

- Spend only ₹5 lakh/year → need just ₹1.25 crore.

👉 Lowering your expenses reduces your retirement target and helps you reach FIRE faster.

Step-by-Step Wealth-Building Plan for Young Adults

Here’s a practical action plan:

- Save at least 20–30% of income in your 20s.

- Build an emergency fund worth 6 months of expenses.

- Pay off credit card or personal loan debt.

- Start SIPs or index fund investments.

- Contribute to tax-advantaged retirement accounts.

- Grow income through skill-building and side hustles.

- Keep expenses low—avoid lifestyle creep.

- Follow FIRE principles and calculate your 4% target.

👉 Stick to this plan consistently for 10–15 years, and you can retire much earlier than most people.

Conclusion: Start Today, Secure Tomorrow

Building wealth in your 20s isn’t about being born rich—it’s about building smart habits. Save early, invest consistently, avoid lifestyle traps, and explore multiple income streams. With discipline and planning, you can retire early and live life on your terms.

👉 Remember, the best time to start was yesterday. The second-best time is today.