Investing in life insurance is a financial decision that goes beyond just protecting your loved ones. In Australia, life insurance can also serve as a strategic investment, offering both financial security and potential wealth accumulation. This comprehensive guide explains everything you need to know, including types of policies, benefits, calculations, and practical examples of life insurance investment.

What Is Life Insurance Investment?

Life insurance investment refers to policies that combine financial protection with an investment component. Unlike traditional term life insurance, which only provides a death benefit, certain policies allow your premiums to accumulate a cash value over time. This cash value can grow through interest, dividends, or market-linked investments depending on the type of policy.

In Australia, the focus is often on death benefits, but permanent policies such as Whole Life or Universal Life also offer investment opportunities.

Types of Life Insurance Investment in Australia

1. Whole Life Insurance

Whole Life Insurance provides lifetime coverage with fixed premiums. Part of your premium contributes to the cash value, which grows at a guaranteed rate.

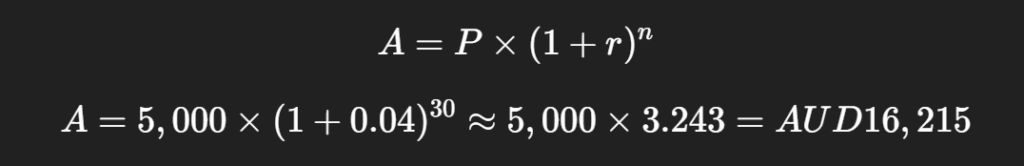

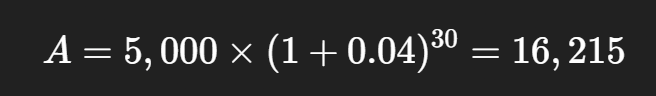

Example:

- Annual premium: AUD 5,000

- Age at inception: 30

- Growth rate: 4% per year

- Duration: 30 years

Using the compound interest formula:

By age 60, the cash value could be AUD 16,215, excluding any dividends.

2. Universal Life Insurance

Universal Life Insurance is flexible, allowing you to adjust premiums and death benefits. Cash value grows with a credited interest rate, which can vary over time.

Example:

- Premium: AUD 5,000 per year

- Interest rate: 3%-6%

- Duration: 30 years

If the interest rate averages 5%, the cash value could reach around AUD 21,610, whereas at 3%, it may only reach AUD 12,150. Flexibility allows for growth optimization but also introduces variability.

3. Variable Life Insurance

Variable Life Insurance lets you invest your cash value in various investment funds (equities, bonds, etc.). The cash value and death benefit fluctuate with market performance.

Example:

- Premium: AUD 5,000 per year

- Investment in diversified equity fund

- Expected growth: 7% per year

However, poor market performance could reduce cash value, making it a higher-risk option.

Benefits of Life Insurance Investment

- Financial Security for Loved Ones

The death benefit ensures that your family can cover living costs, education, and debt repayment. - Tax Advantages

Cash value growth is tax-deferred, and policy loans are generally non-taxable. - Supplement Retirement Income

Access accumulated cash value via loans or withdrawals for retirement or major expenses. - Estate Planning

Life insurance can cover estate taxes and secure wealth transfer. - Debt Protection

Protects family from inheriting mortgages, personal loans, or credit card debt.

Factors Affecting Policy Value

- Age and Health: Younger, healthier Australians enjoy lower premiums.

- Lifestyle: Smoking, risky jobs, or dangerous hobbies increase premiums.

- Policy Type: Term, Whole Life, Universal Life—each has different growth potential and costs.

- Premium Payments: Regular vs. flexible payments affect cash value accumulation.

When Life Insurance Investment Makes Sense

- Financial Dependents: Spouse, children, or ageing parents rely on your income.

- Debt Management: Ensures debts are not a burden on your family.

- Future Planning: Supports education funding, charitable contributions, or inheritance planning.

Calculating Life Insurance Investment Returns

Scenario: You invest AUD 5,000 annually in a Whole Life policy starting at age 30 for 30 years.

- Growth rate: 4% per year

- Total premiums paid: 5,000 × 30 = AUD 150,000

Using compound interest:

The guaranteed cash value is lower than total premiums, but dividends and additional interest can increase value, making it a reliable long-term strategy with lower risk than equity markets.

Alternatives to Life Insurance Investment

- Savings Accounts & Term Deposits – Safe but lower returns.

- Superannuation-Linked Insurance – Often lower premiums but less flexible.

- Shares or Mutual Funds – Higher returns potential but higher risk.

While alternative investments may offer higher growth, life insurance provides guaranteed death benefits, which alternatives cannot match.

Risks of Life Insurance Investment

- High Premiums – Permanent policies cost more than term life.

- Market Risks – Variable policies depend on investment performance.

- Complexity – Understanding terms and conditions can be challenging.

- Loan & Withdrawal Impact – Borrowing against cash value reduces death benefit.

Tips for Australians Considering Life Insurance Investment

- Assess Your Needs – Do you need coverage for dependents or as an investment?

- Compare Policies – Look at premiums, cash value growth, and fees.

- Consult a Financial Advisor – Tailored guidance ensures optimal decisions.

- Consider Superannuation-Linked Options – Useful for lower premiums but less flexibility.

- Plan for Long-Term – Cash value accumulation benefits those who hold policies for decades.

Also Read: Protect Financial Future Smart Insurance Planning

Conclusion

Life insurance investment in Australia is not just about protecting your family—it’s a strategic financial tool that can offer long-term growth, tax benefits, and peace of mind. By understanding policy types, benefits, risks, and calculating potential returns, Australians can make informed decisions to secure their financial future.

Permanent life insurance is best suited for those looking for both protection and wealth accumulation, while alternatives like superannuation-linked insurance or traditional investments can complement your financial strategy. Consulting a financial advisor is essential to tailor the best plan for your needs.