Retirement is one of the biggest financial goals in life. Planning for retirement means understanding how superannuation, Age Pension, personal savings, and investments all work together. With life expectancies rising and living costs increasing, it’s no longer enough to just contribute to super and hope for the best.

This retirement planning comparative guide will help you understand different strategies, compare the benefits of self-planning versus professional advice, and use real examples and calculations to see how much you may need for a comfortable retirement.

Why Retirement Planning Matters

According to the Association of Superannuation Funds of Australia (ASFA), a “comfortable retirement” for a couple currently requires around $72,148 per year (as of 2025), while a single person needs about $51,278 per year. These figures assume retirees own their home and are relatively healthy.

However, inflation and longevity risk mean you may need more than you expect. Without careful planning, you risk:

- Running out of savings too early

- Relying heavily on the Age Pension (currently about $29,000 per year for singles, $43,700 for couples)

- Lower quality of life due to reduced disposable income

Key Elements: Retirement Planning Comparative Guide

- Superannuation – Employer contributions (11.5% in 2025) plus voluntary contributions, concessional and non-concessional caps, and investment options.

- Age Pension – Government safety net, but means-tested based on assets and income.

- Investments outside super – Shares, ETFs, property, term deposits.

- Retirement income products – Account-based pensions, annuities, and lump sums.

- Tax planning – Super contributions and withdrawals have different tax treatments before and after age 60.

Comparing Retirement Planning Approaches

Let’s look at different strategies people use, their pros and cons, and when they might suit you best.

| Strategy | What It Involves | Pros | Cons | Best For |

| No plan | Rely on super and Age Pension without active planning | No effort | High risk of shortfall | Low-income earners who expect to rely fully on Age Pension |

| DIY self-planning | Use calculators (ASIC’s Moneysmart, super funds’ tools), spreadsheets | Full control, low cost | Easy to make wrong assumptions | Financially savvy individuals |

| Online tools/software | Paid or free modelling tools (e.g. Moneysmart Retirement Planner, super fund calculators) | Scenario testing | May not reflect personal circumstances | Middle-income people wanting guidance |

| Financial advisor | Licensed adviser creates tailored plan (super, tax, estate) | Expertise, discipline, personalised | Advice fees ($2,000–$4,000 upfront, ongoing fees extra) | People with complex finances, high balances |

| Hybrid approach | DIY with periodic professional check-ins | Balance of cost and expertise | Requires engagement | Suits most people |

Example: How Much Super Do You Need?

Let’s calculate retirement needs for a couple.

- Current age: 35

- Retirement age: 67

- Life expectancy: 92 (25 years in retirement)

- Target lifestyle: Comfortable (ASFA estimate $72,148/year in today’s dollars)

- Inflation: 2.5% p.a.

- Real investment return after retirement: 3%

Step 1: Future annual expense at retirement

So, at age 67, the couple will need about $157,000 per year to match today’s $72k standard.

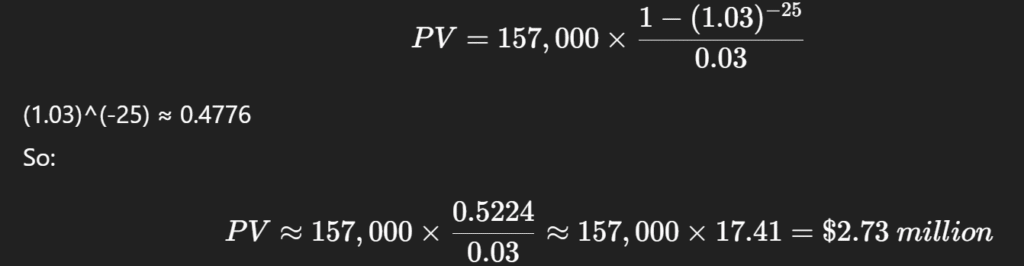

Step 2: Total savings required at retirement

They will need that income for 25 years. Using Present Value of an annuity:

Where:

- P = $157,000 (annual income)

- r = 3% = 0.03 (real return during retirement)

- n = 25 years

So, this couple will need around $2.7 million in super and savings by age 67.

Step 3: Required annual contributions

Let’s say they currently have $100,000 in super combined at age 35. They want to grow it to $2.7m in 32 years.

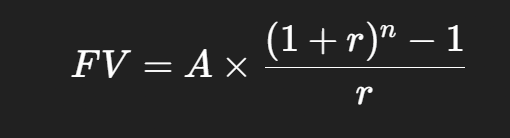

Using Future Value of an annuity formula:

Where:

- FV target = $2,700,000

- Current balance = $100,000 (which will also grow)

- r = 5% = 0.05 (assumed annual return during accumulation)

- n = 32 years

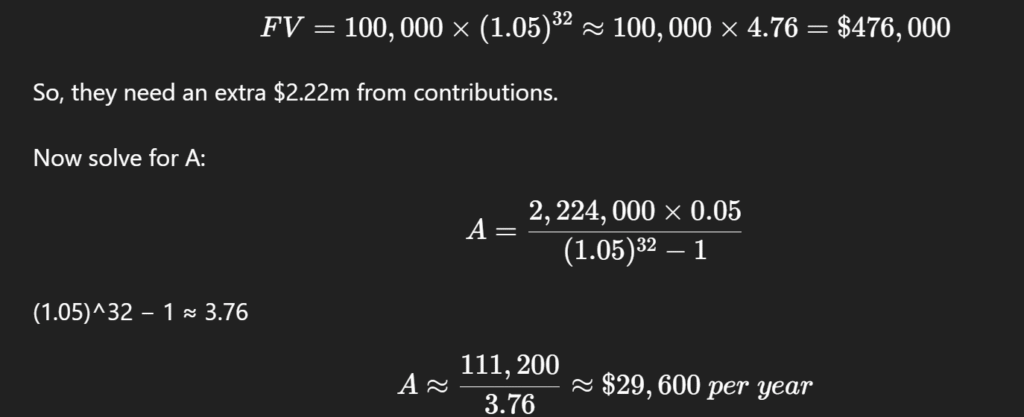

First calculate future value of current $100,000:

So, they need to contribute around $30,000 per year combined into super and investments to reach the goal.

Role of the Age Pension

The Age Pension plays a big role in retirement planning. Many people will be partly or fully eligible, depending on the assets test and income test.

- Full pension (2025): around $29,000 for singles, $43,700 for couples.

- Cut-off assets (homeowners): around $1.2m for couples, $900k for singles.

This means that people with moderate balances (say $500k–$1m) may not need $2.7m, because the Age Pension will top up their income. However, wealthier retirees may get little or no pension and need to self-fund fully.

Super vs Non-Super Investments: A Comparison

| Factor | Superannuation | Non-Super Investments |

| Tax treatment | Concessional contributions taxed at 15%, withdrawals tax-free after 60 | Normal marginal tax rates apply |

| Accessibility | Locked until preservation age (usually 60) | Accessible anytime |

| Investment choice | Depends on fund (default, balanced, high growth) | Full flexibility (shares, ETFs, property, term deposits) |

| Government rules | Contribution caps, preservation rules | Fewer restrictions, but less tax-efficient |

| Best for | Long-term compounding for retirement | Flexibility, diversification, pre-retirement goals |

DIY vs Financial Planner

- DIY planning works if you’re comfortable with numbers, can use tools like Moneysmart Retirement Planner, and stick to discipline.

- Financial advisors can optimise contributions (salary sacrifice, spouse contributions), investment choice, and tax strategies (transition to retirement pensions, recontribution strategies).

Advisory fees in Australia can be $2,000–$4,000 upfront plus annual review fees. For someone with $500,000+, the value of avoiding mistakes may outweigh the cost.

Also Read: Saving for Retirement Its Not Too Late to Start at 40

Risks to Consider in Retirement Planning

- Longevity risk – Living longer than expected. Many people live well into their 90s.

- Market risk – Investment returns fluctuate; a downturn early in retirement can hurt more.

- Inflation risk – Medical and aged care costs grow faster than general inflation.

- Policy risk – Superannuation and pension rules change with governments.

Practical Checklist for Everyone

✔ Estimate your retirement lifestyle cost using ASFA standards.

✔ Check your super balance and projected growth with Moneysmart calculators.

✔ Understand how much Age Pension you may qualify for.

✔ Decide on contribution strategy – salary sacrifice, after-tax contributions, spouse contributions.

✔ Diversify investments inside and outside super.

✔ Review annually – adjust for salary, inflation, and market performance.

✔ Consider a financial planner for complex cases (high assets, multiple income streams).

Conclusion: Retirement Planning Comparative Guide

Retirement planning is not one-size-fits-all. A young couple in their 30s will need a different strategy than someone in their late 50s.

- If you rely only on the Age Pension, your lifestyle will be limited.

- If you plan carefully and contribute consistently to super, you can achieve financial independence.

- Using a financial adviser can add value if your finances are complex, but many people succeed with DIY planning using free tools.

The key is to start early, save consistently, review often, and use both superannuation and other investments strategically. By comparing your options and making realistic assumptions, you can retire with confidence.