Retirement is often described as the “golden years.” For Australians, it represents a chance to slow down, pursue hobbies, travel, and spend more time with family. But whether your retirement is comfortable or stressful depends on how well you plan today.

In Australia, retirement planning is closely tied to superannuation (super), the Age Pension, and smart investing. But super alone may not be enough. You need to combine government support, employer contributions, personal savings, and investment strategies to build a secure future.

This blog will give you practical retirement planning tips secure comfortable future, with examples, calculations, and strategies that can help you prepare for a financially stress-free retirement.

Retirement Planning Tips Secure Comfortable Future

1. Know How Much You Need for Retirement

Before you can plan, you must know your target.

a) ASFA Retirement Standard

The Association of Superannuation Funds of Australia (ASFA) publishes the Retirement Standard, which estimates how much money Australians need for a modest or comfortable lifestyle.

As of 2025 (approx.):

- Modest lifestyle: around $31,000/year (single) or $45,000/year (couple).

- Comfortable lifestyle: around $51,000/year (single) or $72,000/year (couple).

b) Example: Target Retirement Corpus

Suppose you want a comfortable lifestyle as a couple needing $72,000 per year.

Using the “rule of 25” (annual expenses × 25):

72,000×25=1.8 million dollars

So, you’ll need about $1.8 million in retirement savings (including super, investments, and Age Pension supplements).

c) Don’t Forget Inflation

At 3% annual inflation, today’s $72,000 will cost around $130,000 in 20 years.

That’s why your investment strategy must outpace inflation.

2. Maximise Your Superannuation

In Australia, superannuation is the backbone of retirement planning.

a) Employer Contributions

Your employer must contribute 11.5% of your salary into your super in 2025 (gradually rising to 12% by 2026).

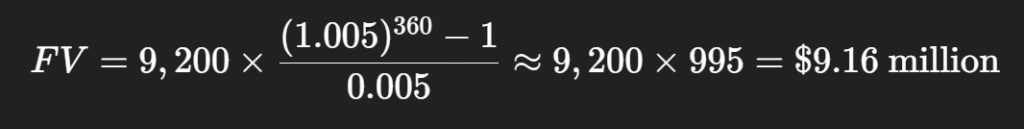

Example:

- Salary = $80,000

- Employer contribution = $80,000 × 11.5% = $9,200/year

Over 30 years (with 6% growth):

That’s the power of compounding inside super.

b) Voluntary Contributions

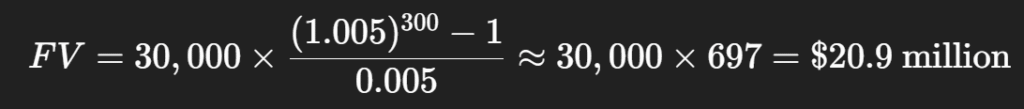

Boost your super through:

- Concessional contributions (before-tax): up to $30,000/year cap in 2025. Taxed at 15% instead of marginal rates (good for high earners).

- Non-concessional contributions (after-tax): up to $120,000/year.

c) Government Co-contribution

If you earn less than ~$45,000/year and make after-tax contributions, the government may contribute up to $500 extra per year.

d) Catch-Up Contributions

If your super balance is below $500,000, you can carry forward unused concessional contribution caps for up to 5 years.

3. Understand the Age Pension

Not all Australians will be fully self-funded in retirement. The Age Pension acts as a safety net.

a) Eligibility

- Age requirement: 67 years (by 2023 onwards).

- Income & assets test: Determines how much pension you receive.

b) Pension Rates (2025 estimates)

- Single full pension: ~$1,100 per fortnight (~$28,600/year).

- Couple combined full pension: ~$1,650 per fortnight (~$43,000/year).

c) Example: Blended Retirement

If you retire with $800,000 in super as a couple, you may still qualify for a part Age Pension, which can add ~$20,000–$25,000 annually to your retirement income.

This shows why planning must consider both super + Age Pension.

4. Diversify Beyond Super

Relying only on super may not be enough. Consider building wealth outside super for flexibility.

Investment Options in Australia

- Managed funds / ETFs: Low-cost access to diversified portfolios.

- Shares: Australian shares offer franking credits, making them tax-efficient.

- Property: Residential property investment remains popular but needs careful cash flow analysis.

- Bonds / Fixed income: Safer but lower returns — useful closer to retirement.

- Self-Managed Super Funds (SMSFs): For experienced investors wanting control.

Example: Franking Credits

If you receive $10,000 in fully franked dividends from Australian shares, you also get franking credits worth about $4,285, reducing your tax bill or even giving you a refund.

This boosts net retirement income significantly.

5. Plan for Healthcare & Insurance

Healthcare can be one of the largest retirement costs.

- Private Health Insurance: Consider continuing cover to reduce out-of-pocket costs.

- Aged Care Costs: Entry to aged care facilities can require a significant refundable accommodation deposit (RAD), sometimes over $400,000.

- Insurance in Retirement: Review life and income protection policies — some may no longer be necessary after you stop working.

Example: Healthcare Cost Projection

At 3% inflation, today’s $5,000 annual health expense will be:

So, expect costs to almost double in 20 years.

6. Use Tax Strategies for Retirement

Tax planning is key in Australia.

a) Transition to Retirement (TTR) Strategy

From preservation age (between 55–60 depending on birth year), you can start drawing a pension from super while still working — lowering taxable income.

b) Account-Based Pensions

Once retired, you can convert your super into an account-based pension, which provides:

- Tax-free income in retirement.

- Tax-free investment earnings inside the pension account.

c) Downsizer Contribution

If you sell your family home after age 55, you can contribute up to $300,000 each (per individual) into super — even if you’ve hit contribution caps.

Example

Couple sells their home for $1.2 million. They downsize and contribute $600,000 into super (300k each). This increases their retirement corpus, providing more tax-free pension income.

7. Withdrawal & Income Strategies

How you draw income matters.

- Safe Withdrawal Rate (SWR): A common rule is withdrawing 4% annually. But in Australia, a more conservative 3–3.5% may be safer.

- Bucket Strategy:

- Short-term needs (cash, bonds).

- Medium-term (balanced funds).

- Long-term (shares, growth assets).

- Short-term needs (cash, bonds).

Example

Couple has $1 million.

- Bucket 1: $100k in cash (2 years expenses).

- Bucket 2: $300k in balanced funds.

- Bucket 3: $600k in equities for long-term growth.

This reduces the risk of selling shares in a market downturn.

8. Avoid Common Retirement Planning Mistakes

- Not starting early enough → less compounding.

- Relying only on Age Pension → risk of low income.

- Ignoring inflation → purchasing power erodes.

- Failing to diversify → portfolio too risky or too conservative.

- Not reviewing your plan → life circumstances change.

Case Study: Australian Retirement Planning

Profile:

- Sarah & John, both 40, earning $100k each.

- Aim: Retire at 65 with a comfortable lifestyle (~$72,000/year).

Step 1: Current Super Balance

- Combined = $200,000.

Step 2: Future Contributions

- Employer + personal = $30,000/year combined.

Step 3: Projection

At 6% growth, by age 65:

Add current balance $200,000 × (1.06)^{25} ≈ $860,000.

Total Super Balance ≈ $2.95 million at 65.

Step 4: Retirement Income

At 4% withdrawal: $2.95m × 4% = $118,000/year.

This easily exceeds the ASFA “comfortable” level. Even if markets underperform, they should be well-funded.

Also Check: Retirement Planning Comparative Guide: A Global Perspective

Review Regularly & Seek Professional Advice

Retirement planning is not a “set and forget” task. You should:

- Review your super fund performance annually.

- Adjust asset allocation as retirement nears.

- Seek advice from a licensed financial adviser in Australia.

- Update estate planning documents (wills, super beneficiary nominations, powers of attorney).

Conclusion

Retirement planning in Australia requires a smart mix of superannuation contributions, Age Pension strategies, diversified investments, tax efficiency, and healthcare planning. The earlier you start, the more compounding works in your favour.

Whether you dream of travelling the world, living by the beach, or simply enjoying peace of mind, the key is to plan, act, and review regularly. With clear goals and disciplined saving, you can look forward to a secure and comfortable future.