Planning for retirement is one of the biggest financial decisions Australians face. With life expectancy increasing and living costs rising, many people wonder if their savings will last long enough. A financial advisor can help you structure a plan — but only if you ask the right questions.

In this blog, we’ll cover the most important retirement questions discuss financial advisor in Australia. You’ll also see examples, calculations, and tax considerations relevant to superannuation, the Age Pension, investment strategies, and healthcare costs.

Why Asking Retirement Questions Matters in Australia

Unlike in some countries, Australians rely on a three-pillar retirement system:

- Superannuation – your mandatory retirement savings (currently 11.5% of wages in 2025).

- Age Pension – government support, subject to means testing.

- Personal Savings & Investments – property, shares, term deposits, managed funds, etc.

Because these systems interact in complex ways (taxation of super, eligibility for Age Pension, contribution limits), your financial future can change drastically depending on timing and strategy. Asking the right questions ensures your advisor tailors a plan to your exact situation.

Key Retirement Questions Discuss Financial Advisor

1. Am I on Track to Retire Comfortably?

Why Ask

You need to know whether your super balance plus other savings will cover your retirement lifestyle.

Example Calculation

The Association of Superannuation Funds of Australia (ASFA) estimates (2025) that for a comfortable retirement:

- Single person: about $51,000/year

- Couple: about $72,000/year

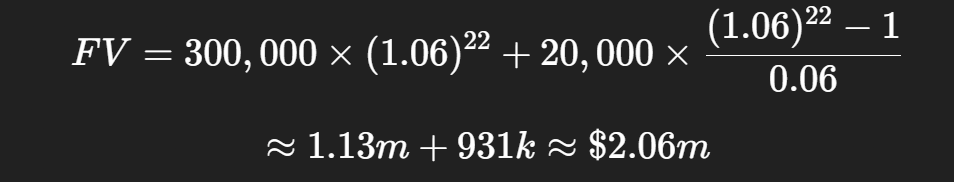

Suppose you are 45 with $300,000 in super, contributing $20,000 annually (including employer). If your fund grows at 6% p.a. and you retire at 67:

Future value of super ≈

At 67, withdrawing 4% annually means ≈$82,000/year, enough for a couple’s comfortable retirement.

Ask your advisor: Am I saving enough, or do I need to increase contributions?

2. How Should I Use My Superannuation in Retirement?

Why Ask

At retirement, you can either:

- Take a lump sum

- Start an account-based pension (draw income)

- Buy an annuity

Each choice has tax and longevity implications.

Example

If you retire with $800,000 in super and move it into an account-based pension:

- Income payments are tax-free if you’re over 60.

- But your money remains invested, so market risk continues.

If instead you buy a lifetime annuity that pays $45,000/year guaranteed, you trade flexibility for security.

Your advisor should model which option suits your lifestyle and risk tolerance.

3. How Do I Maximise Age Pension Benefits?

Why Ask

The Age Pension (from Centrelink) can supplement super but depends on income and assets tests.

Example

- Full single Age Pension ≈ $29,000/year (2025).

- Couples combined ≈ $44,000/year.

If you retire with $500,000 in assets (excluding family home), you may qualify for a part-pension.

- If assets rise above thresholds (≈$1,012,500 for homeowners, couples), pension reduces.

A financial advisor can suggest strategies like gifting within limits, structuring super accounts, or adjusting investment ownership between spouses to maximise benefits.

4. How Can I Minimise Taxes in Retirement?

Why Ask

Australia offers generous tax advantages for retirees. Knowing how to use them is crucial.

- Earnings inside super pension phase are tax-free.

- Withdrawals from super after age 60 are tax-free.

- Outside super, capital gains tax (CGT) and income tax apply.

Example

If you have $200,000 in shares outside super, selling them all at once may trigger large CGT. Instead, selling $20,000/year may keep you below tax thresholds.

Ask your advisor: How can I draw income in a tax-efficient order (super vs savings vs investments)?

5. What Investment Strategy Should I Follow in Retirement?

Why Ask

The right asset allocation protects your money from both market downturns and inflation.

Example

Say you have $1 million.

- Option A: 100% in term deposits at 4% = $40,000/year income. But inflation (3%) erodes real value.

- Option B: 60% shares, 40% bonds with average 6% return = $60,000/year. Riskier, but higher growth.

Your advisor should show risk scenarios and use Monte Carlo simulations to test portfolio success under thousands of market conditions.

6. Should I Pay Off My Mortgage Before Retirement?

Why Ask

Many Australians approach retirement with some mortgage left. Deciding whether to clear it or invest is critical.

Example

Mortgage: $300,000 at 6% interest = $18,000/year cost.

If your super investment yields 7%, you’re gaining 1% margin — but with risk.

Advisors often suggest clearing debt for peace of mind, unless you’re confident in long-term investment returns.

7. How Do I Protect Against Healthcare and Aged Care Costs?

Why Ask

Medical costs rise with age, and aged care (residential facilities) can be expensive.

Example

- Basic aged care accommodation deposit: $400,000+

- Daily care fees: $60–$100/day

Ask your advisor:

- Should I keep extra liquidity for medical emergencies?

- Do I need private health insurance or aged care bonds?

8. Should I Leave an Inheritance or Focus on My Lifestyle?

Why Ask

Many Australians want to leave assets for children. Others prioritise enjoying retirement. Your plan should balance both.

Example

If you retire with $1.2m:

- Spending $70,000/year may leave little by age 90.

- Spending $50,000/year may leave $400,000+ as inheritance.

Your advisor should run projections based on your family goals.

9. How Transparent Are Your Fees and Services?

Why Ask

In Australia, advisors must disclose fees and whether they are independent or tied to product providers.

Ask:

- Are you fee-only, commission-based, or hybrid?

- What are your annual fees as % of portfolio?

- Do you receive incentives for recommending products?

This helps you understand if advice is unbiased.

Practical Checklist Before Meeting Your Advisor

- ✅ Estimate your retirement lifestyle cost (use ASFA standard).

- ✅ Collect all super statements.

- ✅ List mortgage, debts, investments, insurances.

- ✅ Note health, family, and inheritance goals.

- ✅ Prepare the 9 questions above.

This preparation ensures your session is productive.

Also Check: Roadmap Financial Independence Early Retirement Planning

Conclusion

Retirement planning in Australia isn’t just about saving more — it’s about asking your financial advisor the right questions. By discussing superannuation strategies, Age Pension eligibility, tax-efficient withdrawals, debt management, investment allocations, and healthcare planning, you can create a retirement plan that supports both comfort and peace of mind.

Remember: your advisor’s answers should be clear, numerical, and tailored to your life. Don’t settle for vague advice — bring these questions to the table and ensure you get the retirement you deserve.