Retirement is a big milestone — a time when you finally step away from work and rely on your savings, superannuation, and other income sources. But while many Australians focus on how much super is enough, there’s much more to think about. From tax rules and government benefits to healthcare and housing, a smooth retirement requires planning across multiple fronts.

This blog explores the retiring financial considerations in Australia that every future retiree should understand. With worked examples and easy calculations, we’ll help you see the full picture and prepare for a secure and stress-free retirement.

Why Retirement Planning is More Than Just Super

Australia’s retirement system is unique. We have:

- Compulsory superannuation contributions (currently 11.5% of wages in 2025).

- Age Pension for eligible retirees, depending on assets and income.

- A mix of personal savings, property, and investments.

While superannuation is central, retirees also face issues like tax planning, healthcare (Medicare and private insurance), housing choices, and estate planning. If you only think about super, you may miss crucial financial risks.

Top 9 Retiring Financial Considerations

1. Income Sources in Retirement

Main income streams

Australians in retirement typically draw from:

- Superannuation pensions (account-based pensions, annuities).

- Age Pension (government support, subject to means tests).

- Investments (shares, property, managed funds).

- Savings and term deposits.

- Part-time work (if desired).

Example: Super + Age Pension mix

Let’s assume Mary retires at age 67 with:

- Super balance: $600,000 (account-based pension).

- She owns her home.

- She has no other major assets.

She withdraws 4% in the first year = $24,000.

She is also eligible for a part Age Pension of around $15,000/year (estimate, based on current Centrelink thresholds).

So her income = $39,000/year, which may be enough for a modest lifestyle according to ASFA’s Retirement Standard.

2. Safe Withdrawal Strategies

A common question is: “How much can I take out each year without running out?”

The 4% Rule (with an Australian twist)

The “4% rule” suggests you can withdraw 4% of your savings each year, adjusted for inflation, with a good chance of lasting 30 years.

Example:

- Super balance: $800,000

- First year withdrawal: 4% = $32,000

- Add part Age Pension: $12,000

- Total income: $44,000

This aligns closely with the ASFA “comfortable retirement” standard for a single retiree ($51,278/year as of 2025).

Guardrail approach

Instead of fixed withdrawals, you can adjust based on portfolio performance:

- Withdraw less in years when markets are down.

- Withdraw more when investments grow strongly.

This helps protect against running out of funds too early.

3. Longevity and Inflation Risks

Australians are living longer

According to ABS data, a 65-year-old man can expect to live to around 85, while a woman may live to 88–90. That means your money may need to last 25+ years.

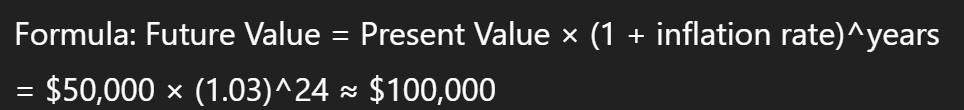

The inflation effect

If inflation averages 3%, today’s $50,000 lifestyle will cost over $100,000 in 24 years.

This shows why investments that keep pace with inflation (like shares and property) matter.

4. Tax Considerations in Retirement

Australia has generous tax breaks for retirees, but the rules are complex.

Superannuation tax rules

- If you’re 60 or over, super pension payments are usually tax-free.

- Earnings inside a retirement pension account (up to the transfer balance cap, currently $1.9 million) are also tax-free.

Age Pension means tests

- The assets test and income test decide how much pension you receive.

- Example: A couple who own their home can have up to $1,021,500 in assets and still receive a part Age Pension.

Example: Tax-free income strategy

John (age 67) has:

- $700,000 in super (pension phase) → withdraws $28,000 tax-free

- $300,000 in shares outside super → earns $15,000 dividends (with franking credits)

- Eligible for $10,000 Age Pension

Total net income = $53,000 with minimal tax liability, thanks to superannuation rules.

5. Healthcare and Insurance

Healthcare costs can be unpredictable in retirement.

Medicare + private cover

- Medicare covers most basic healthcare, but not dental, physio, or some hospital costs.

- Many retirees keep private hospital cover to avoid waiting lists.

Long-term care costs

Residential aged care in Australia can be expensive. Costs include:

- Basic daily fee (85% of pension, ~ $60/day in 2025).

- Accommodation payment (refundable deposit or daily charge).

- Means-tested care fees (based on income and assets).

Example: If a retiree enters residential care with assets of $400,000, Centrelink may assess a daily means-tested fee of around $30–$50/day, in addition to the basic fee.

Planning for aged care is a critical financial consideration.

6. Housing and Downsizing

Housing decisions can make or break retirement finances.

Downsizer contribution

Australians aged 55+ can contribute up to $300,000 per person from selling their family home into super, regardless of contribution caps.

Example:

- Couple sells home for $1.2 million.

- Buys smaller unit for $800,000.

- Net proceeds = $400,000.

- Each spouse contributes $200,000 into super (downsizer contribution).

- This boosts retirement savings and may provide tax-free income streams.

Rent vs own

Some retirees consider selling their home to rent, freeing capital. But you must consider:

- Rent rises (inflation risk).

- Age Pension rules (home ownership affects assets test).

7. Estate Planning and Legacy

Must-have documents

- Will (to distribute assets).

- Enduring power of attorney (financial decisions if you lose capacity).

- Advance care directive (medical decisions).

- Binding death benefit nomination for super (ensures your super goes to chosen beneficiaries).

Example: Super death benefit tax

If super goes to a dependent (spouse/child under 18) → tax-free.

If it goes to a non-dependent (adult child) → taxed up to 15% on the taxable component.

This makes planning beneficiary nominations crucial.

8. Risk Management and Contingencies

Even the best plans need buffers.

- Keep 2–3 years of expenses in cash or term deposits, so you don’t sell shares during downturns.

- Diversify investments across asset classes (shares, bonds, property, cash).

- Stress test: What if markets fall 20%? What if healthcare costs rise sharply?

Example: Emergency buffer

If your annual expenses = $50,000, then aim for $100,000–$150,000 in liquid assets outside volatile markets.

9. Retirement Readiness Checklist (Australia Focus)

Here’s a 10-year countdown to retirement:

| Years Before | Key Actions |

| 10 | Maximise super contributions, consolidate accounts |

| 9 | Check projected super balance (via MyGov/ATO tools) |

| 8 | Pay down mortgage, consider investment property strategy |

| 7 | Estimate Age Pension eligibility |

| 6 | Explore private health insurance options |

| 5 | Decide retirement lifestyle (travel, hobbies, location) |

| 4 | Consider downsizer contributions, review housing |

| 3 | Finalise investment strategy for low-risk income |

| 2 | Draft or update will, POA, beneficiary nominations |

| 1 | Apply for Age Pension (if eligible), set first-year withdrawal plan |

Worked Example: Australian Couple Retiring

Case study: David and Sarah, both 66

- Combined super: $1,000,000 (balanced pension account).

- Own home worth $900,000 (mortgage-free).

- Savings outside super: $50,000.

Income plan

- 4% withdrawal from super = $40,000

- Age Pension (part) = $18,000

- Term deposit interest = $2,000

Total income = $60,000/year, tax-free.

This meets the ASFA comfortable standard for couples ($72,148 in 2025). They can adjust by drawing slightly more in strong years or downsizing their home later to top up super.

Also Check: Retirement Questions Discuss Financial Advisor in Australia

Conclusion

Retirement in Australia isn’t just about having a big super balance — it’s about managing all the moving parts. From withdrawal strategies and tax rules to healthcare, housing, and estate planning, each decision affects your long-term financial security.

By understanding the retiring financial considerations outlined in this guide, Australians can build a plan that balances lifestyle goals with financial sustainability. Start early, use government tools, seek professional advice when needed, and adjust as your life circumstances change.

A well-planned retirement means less stress, more freedom, and the ability to enjoy the years you worked so hard for.