Superannuation, commonly known as super, is one of the most important parts of financial planning in Australia. It is designed to help people save money for retirement and live comfortably after they stop working. While it may seem complex at first, understanding the basics of superannuation can make a big difference to your future financial security.

In this guide, we’ll explain super in simple terms, cover how it works, show examples with calculations, and share strategies to help you get the most out of your super. Whether you are starting your first job or already working, this blog will help you clearly understand how superannuation supports your future.

What Is Superannuation?

Superannuation is a long-term savings system where money is put aside during your working life and invested by your super fund. These savings are then available to you in retirement, usually after you reach a certain age or meet other legal conditions.

Key features include:

- Compulsory contributions by employers under Australian law.

- Optional personal contributions to boost savings.

- Investment growth over time with compound interest.

- Tax advantages, making super more efficient than regular savings.

Understanding the Basics of Superannuation

Employer Contributions: The Super Guarantee (SG)

Employers in Australia must pay a percentage of your salary into your super account. This is called the Super Guarantee (SG).

- Current SG rate (2025): 12% of ordinary time earnings

- From 1 July 2026, super contributions will need to be paid at the same time as wages, not quarterly.

Example Calculation

If Emma earns AUD 70,000 per year, her employer must contribute:

70,000×12%=8,400 per year

This means that without Emma doing anything extra, her employer is already setting aside AUD 8,400 every year for her retirement.

Voluntary Contributions: Boosting Your Super

Apart from employer contributions, you can add extra money to your super in two main ways:

- Concessional contributions (before-tax):

- Salary sacrifice or personal contributions claimed as a tax deduction.

- Taxed at 15% inside the fund, which is usually lower than personal tax rates.

- Salary sacrifice or personal contributions claimed as a tax deduction.

- Non-concessional contributions (after-tax):

- Money you add from your take-home income.

- Not taxed inside the fund because it’s already taxed as income.

- Money you add from your take-home income.

Example

James earns AUD 90,000/year. His employer contributes AUD 10,800/year (12%).

He decides to add an extra AUD 2,000 after-tax contribution each year.

- Employer contribution: AUD 10,800/year

- Personal contribution: AUD 2,000/year

- Total annual contribution = AUD 12,800

Over time, this extra AUD 2,000 makes a huge difference due to compounding.

How Superannuation Grows: Compound Interest

One of the most powerful features of super is compound interest. This means your contributions earn investment returns, and those returns themselves also earn more returns over time.

Example: Growth Over 20 Years

Sarah, age 25, earns AUD 80,000/year. Her employer contributes AUD 9,600/year.

Assume:

- Investment return (after fees/tax) = 5% per year

- Contribution = AUD 9,600/year

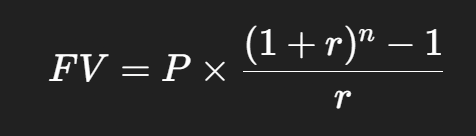

Using the future value formula:

Where:

- P=9,600

- r=0.05

- n=20

So after 20 years, Sarah could have around AUD 317,000 in super—without adding anything extra herself.

Investment Options in Super

Super funds invest your money in different assets. Most funds let you choose between:

- Growth option: Higher risk, higher expected return (mostly shares).

- Balanced option: Mix of shares, bonds, and property.

- Conservative option: Lower risk, lower return (cash and fixed interest).

Your choice of investment option can significantly affect your final super balance.

The Impact of Fees

Super funds charge fees for managing your money. Even small differences in fees can make a big impact over decades.

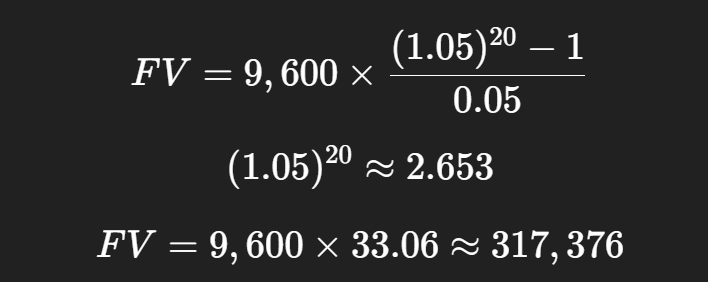

Example

Two people each invest AUD 10,000/year for 30 years, earning 6% per year:

- Fund A fees = 1.5% → Net return = 4.5%

- Fund B fees = 0.5% → Net return = 5.5%

Using future value:

Difference = AUD 86,000 just from lower fees!

Insurance in Super

Most super funds include life insurance, total and permanent disability (TPD), and income protection. While this provides useful cover, it also reduces your super balance over time due to premiums being deducted.

It’s important to:

- Review your insurance needs.

- Avoid paying for multiple policies across different funds.

- Balance insurance cover with long-term savings growth.

Consolidating Super Accounts

Many Australians have multiple super accounts from different jobs. This leads to:

- Extra fees.

- Duplicate insurance policies.

- Lost super balances.

The Australian Taxation Office (ATO) provides tools via myGov to find and consolidate multiple accounts. Having one super account helps you save money and manage your retirement savings more effectively.

Accessing Your Super

You usually can’t access your super until you reach your preservation age (between 55 and 60 depending on your birth year) and retire. Other conditions of release include:

- Turning 65.

- Severe financial hardship.

- Permanent disability or illness.

When you access super in retirement, withdrawals may be tax-free if you are over 60.

Real-Life Scenario: Retirement Projection

Let’s take Carla, aged 25 in 2025:

- Salary: AUD 70,000/year

- Employer SG (12%): AUD 8,400/year

- Personal after-tax contributions: AUD 2,000/year

- Investment return: 5% after fees and tax

- Retirement age: 67 (42 years)

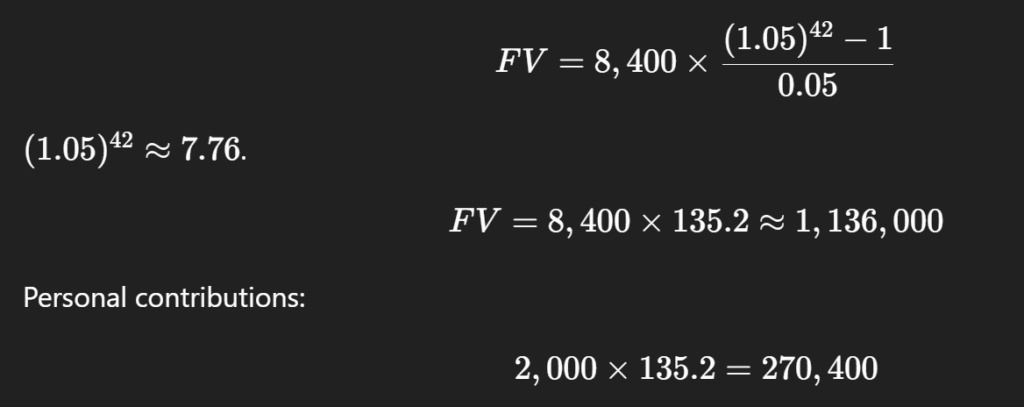

Calculation

Employer stream:

Total at retirement ≈ AUD 1.4 million.

This shows how extra contributions significantly boost retirement savings.

Government Rules and Tax Benefits

- Contribution caps: There are yearly limits on how much you can contribute before extra tax applies.

- Tax on concessional contributions: 15% inside the fund (lower than most income tax rates).

- Tax on withdrawals: Tax-free after age 60 in most cases.

Government rules are updated regularly, so it’s important to check the ATO website for the latest information.

Tips to Maximise Your Super

- Check your fund’s fees and performance.

- Make voluntary contributions if possible. Even small amounts make a big difference.

- Consolidate accounts to avoid unnecessary fees.

- Review insurance in super to make sure it matches your needs.

- Use super calculators from ATO or your fund to plan for retirement.

- Stay updated with rule changes.

Conclusion

Superannuation is not just a legal requirement—it is your future financial foundation. Understanding how contributions, investments, tax, and fees affect your super can help you take control of your retirement savings.

By making smart choices today—like consolidating accounts, reviewing fees, making voluntary contributions, and choosing the right investment option—you can significantly increase your retirement balance.

Superannuation is a long-term game, and the earlier you start understanding and managing it, the more secure and comfortable your retirement will be.