Retirement is a significant milestone in life. For Australians, it’s not just about stopping work—it’s about enjoying your golden years with financial security and peace of mind. To achieve this, planning ahead is crucial. Without a clear plan, retirees risk running out of funds, facing unexpected expenses, or struggling to maintain their desired lifestyle. This blog provides a detailed, step-by-step checklist of A retirees to do list 6 things to plan before retiring, with practical examples and calculations to help you prepare effectively.

A Retirees To Do List 6 Things to Plan Before Retiring

1. Define Your Retirement Goals

The first step in retirement planning is to define what retirement looks like for you. Everyone’s vision of retirement is different, so you need to be clear about your lifestyle preferences. Consider the following:

- Lifestyle Choices: Do you want to travel locally, explore overseas destinations, or spend time on hobbies like gardening, art, or sports?

- Location: Will you stay in your current home, downsize, or relocate closer to family or friends?

- Family Considerations: Will you provide financial support to children or grandchildren, or do you plan to leave a legacy?

- Work Considerations: Do you plan to retire completely or work part-time for extra income or social engagement?

Example

Let’s say you are 60 years old and plan to retire at 65. Your retirement goals include:

- Travelling within Australia for 3 months each year at an estimated cost of AUD 10,000 per year.

- Engaging in hobbies like golf and painting, costing AUD 5,000 per year.

- Supporting an adult child with a university loan repayment of AUD 2,000 per year.

Over a retirement period of 20 years (assuming you live until 85), the total lifestyle cost would be:

Travel: 10,000 × 20 = 200,000 AUD

Hobbies: 5,000 × 20 = 100,000 AUD

Family Support: 2,000 × 20 = 40,000 AUD

Total Lifestyle Cost: 340,000 AUD

This calculation shows the importance of knowing your goals to determine how much you need to save and invest.

2. Create a Retirement Budget

Once your goals are clear, the next step is to estimate your expenses and create a detailed retirement budget. In Australia, retirees should consider the following categories:

- Fixed Costs: Mortgage/rent, utilities, insurance, council rates.

- Variable Costs: Groceries, transport, leisure, dining.

- Healthcare Costs: Medicare, private health insurance, out-of-pocket medical expenses.

- Emergency Fund: Unplanned expenses, such as home repairs or medical emergencies.

Example

Here’s a sample monthly budget for an Australian retiree:

| Expense Category | Monthly (AUD) | Annual (AUD) |

| Housing & Utilities | 2,500 | 30,000 |

| Groceries & Daily Needs | 1,200 | 14,400 |

| Transport | 400 | 4,800 |

| Healthcare | 800 | 9,600 |

| Leisure & Hobbies | 500 | 6,000 |

| Emergency Fund Allocation | 300 | 3,600 |

| Total | 5,700 | 68,400 |

Using this budget, a retiree can calculate the required retirement corpus. Assuming a 20-year retirement, the total required funds would be:

68,400×20=1,368,000 AUD

This figure can be adjusted based on expected inflation, investment returns, and other income streams like the Age Pension.

3. Maximise Superannuation Contributions

Superannuation is one of the most important pillars of retirement planning in Australia. The government provides tax incentives for Australians saving for retirement, and it’s essential to maximise your super contributions, especially if you are approaching retirement age.

Catch-Up Contributions

Australians over 50 can make catch-up contributions if their super balance is lower than desired. This allows you to top up your super before retirement and benefit from compounded growth.

Example

- Current super balance: AUD 400,000

- Extra annual contribution: AUD 10,000

- Expected annual growth rate: 6%

- Period: 10 years

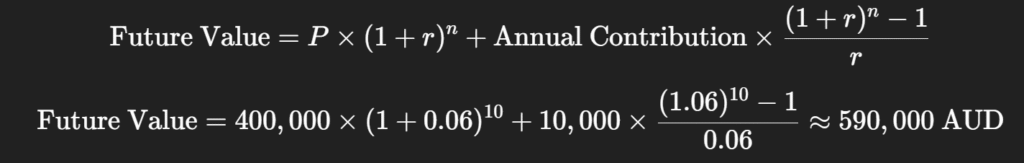

Using the compound interest formula:

This shows how catch-up contributions can significantly increase your retirement savings.

4. Plan Your Age Pension and Retirement Income

The Age Pension is a government-provided income for eligible Australians. Understanding when and how much you can receive is crucial for retirement planning. Combining superannuation withdrawals and Age Pension payments helps ensure a stable retirement income.

Example

- Annual retirement income from super: AUD 50,000

- Age Pension (eligible full payment): AUD 25,000

- Total annual income: AUD 75,000

By planning withdrawals and coordinating with the Age Pension, retirees can avoid running out of money and maintain a comfortable lifestyle.

5. Reduce or Eliminate Debt

Debt can be a major burden during retirement. Paying down debts before retiring frees up cash flow and reduces financial stress. Key debts to focus on include:

- Mortgage: Aim to fully repay before retirement.

- Credit Cards & Personal Loans: High-interest debts should be cleared first.

- Car Loans: Consider downsizing or selling high-value vehicles to reduce expenses.

Example

- Mortgage balance: AUD 300,000

- Interest rate: 5%

- Remaining term: 15 years

- Monthly payment: AUD 2,370

Paying off this mortgage before retiring frees up AUD 28,440 annually, which can be redirected to living expenses, travel, or investments.

6. Consult a Financial Advisor

A financial advisor can help you create a tailored retirement plan. They provide guidance on:

- Investment strategies to balance growth and risk.

- Efficient withdrawal strategies to minimise taxes.

- Estate planning and superannuation strategies.

- Insurance and healthcare planning.

Example

A financial advisor may suggest:

- Diversifying super investments across shares, bonds, and term deposits.

- Using a combination of Age Pension, super drawdowns, and annuities to generate steady income.

- Tax planning strategies to reduce liabilities and maximise benefits.

By leveraging expert advice, retirees can optimise their income and reduce financial risks.

Additional Tips for Australian Retirees

1. Consider Downsizing

Selling a larger family home and buying a smaller property can:

- Release equity for investments.

- Reduce ongoing costs such as utilities, council rates, and maintenance.

Example

- Sell current home for AUD 700,000.

- Buy a smaller home for AUD 450,000.

- Free up AUD 250,000 for investments or travel.

2. Healthcare Planning

- Medicare covers basic healthcare, but out-of-pocket costs can be high.

- Private health insurance helps cover elective procedures and hospital costs.

Example

- Private health insurance premium: AUD 800/month

- Expected annual out-of-pocket costs without insurance: AUD 5,000

- Insurance reduces unexpected medical expenses and ensures quality care.

3. Estate Planning

- Update your will and superannuation nominations.

- Consider setting up a power of attorney.

- Ensure assets are distributed according to your wishes.

Also Read: Guide Starting Retirement Plan in Australia

Conclusion

Planning for retirement in Australia is more than just saving money—it’s about ensuring a lifestyle that aligns with your goals while maintaining financial security. By following this six-step checklist, retirees can:

- Define retirement goals.

- Create a realistic budget.

- Maximise super contributions.

- Plan Age Pension and income streams.

- Reduce or eliminate debt.

- Consult a financial advisor for personalised guidance.

Additional steps like downsizing, healthcare planning, and estate management further enhance your retirement readiness. Remember, the earlier you start, the more secure your retirement will be. Begin planning today, and enjoy a stress-free, fulfilling retirement.