Managing taxes in Australia can be tricky, especially when it comes to claiming financial advice fees. Many Australians wonder whether the money paid to a financial adviser can reduce their tax. The answer is yes, in certain situations. This guide will explain everything you need to know about can you claim financial advice on tax, including practical examples, calculations, tips, and common questions.

What Are Financial Advice Fees?

Financial advice fees are payments made to licensed financial advisers for professional guidance on managing your finances. These fees can cover:

- Investment planning: Advice on shares, managed funds, or investment property.

- Superannuation: Guidance on income-producing super strategies.

- Retirement planning: Advice for tax-effective retirement options.

- Tax strategies: Planning to minimise tax legally.

Financial advice fees can be charged in different ways:

- Hourly Fees – Pay for the time your adviser spends.

- Fixed Fees – A set cost for a particular service.

- Ongoing Fees – Regular payments for continuous support and advice.

Knowing the type of fee is important because it affects how much you can claim as a deduction.

When Can Financial Advice Fees Be Claimed?

The Australian Taxation Office (ATO) allows a deduction for financial advice fees only if the advice is directly related to earning income. This is an important point — advice purely for personal purposes is generally not deductible.

Deductible scenarios include:

- Advice on managing rental properties generating income.

- Guidance on shares or managed funds that pay dividends.

- Tax-effective superannuation strategies for income-producing purposes.

Non-deductible scenarios include:

- Advice on personal budgeting or lifestyle planning.

- Insurance advice for personal life or health insurance.

- Super contributions made for personal reasons, not income-related.

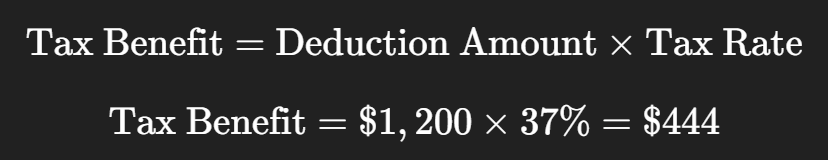

How to Calculate the Tax Benefit

Understanding the tax benefit of claiming financial advice fees is easier with an example.

Scenario 1:

Emma seeks financial advice on her investment property and shares. Her adviser charges $1,200 for the service.

Step 1: Determine deductibility

The advice is income-related, so the fee is deductible.

Step 2: Calculate tax benefit

If Emma’s marginal tax rate is 37%, the tax reduction is:

This means Emma effectively reduces her tax by $444.

Apportionment: When Advice Covers Personal and Income Matters

Sometimes financial advice covers both income-producing and personal matters. In such cases, only the portion related to income-producing activities is deductible.

Scenario 2:

James pays $1,500 for advice on investment shares and personal budgeting.

- 60% relates to investment advice → deductible = $900

- 40% relates to personal advice → non-deductible

If James’s tax rate is 32.5%, the tax benefit is:

$900×32.5%=$292.50

Only $292.50 reduces his tax liability.

Tip: Ask your adviser to provide a breakdown of personal and investment-related advice to simplify claiming deductions.

How to Claim Financial Advice Fees on Your Tax Return

Here’s a step-by-step guide to claim deductions:

- Collect Invoices or Receipts

Keep proof of all fees paid to financial advisers. - Check Deductibility

Ensure the advice relates to income-producing activities. - Include in Tax Return

Add deductible amounts under “Deductions” related to investments or managing tax affairs. - Keep Records

Retain documents for at least five years, as the ATO may request verification.

Examples With Multiple Investments

Scenario 3:

Sophie has:

- Rental property: $2,000 advice fee (income-related)

- Personal super advice: $500 (non-deductible)

Deductible portion = $2,000

Sophie’s tax rate = 37%

Tax Benefit=2,000×37%=740

Sophie can claim $2,000, reducing her tax by $740, while the $500 personal super fee is not deductible.

Common Questions About Financial Advice Deductions

1. Can You Claim Advice Fees for Super Contributions?

- Generally no, unless the advice directly relates to generating income.

2. Can Business Owners Claim Financial Advice Fees?

- Yes. Advice helping manage business income or investments is deductible.

3. Can You Claim Reimbursed Fees?

- No. If your employer reimburses the financial advice fee, you cannot claim it.

Tips to Maximise Tax Deductions

- Separate Personal and Income Advice – Ask advisers for separate invoices.

- Keep Detailed Records – Always retain receipts and invoices.

- Understand Apportionment – Only claim the portion related to income.

- Review Ongoing Fees – Some ongoing service fees are partially deductible each year.

- Consult a Tax Professional – Get tailored advice to maximise deductions.

Deductible vs Non-Deductible Financial Advice Fees (Table)

| Financial Advice Type | Deductible? | Notes |

| Investment property advice | ✅ Yes | Related to income-producing property |

| Share or managed fund advice | ✅ Yes | Income-generating investments |

| Business investment advice | ✅ Yes | Helps manage business income |

| Personal budgeting advice | ❌ No | Personal in nature |

| Insurance advice (life, health) | ❌ No | Not income-related |

| Super contributions advice (personal) | ❌ No | Only income-linked super may qualify |

Key Points to Remember

- Only advice related to income-producing activities is deductible.

- Keep proper invoices, receipts, and records.

- Personal and lifestyle advice is not deductible.

- Apportion fees if advice covers personal and investment matters.

- Reimbursed advice fees cannot be claimed.

Also Read: How Technology Transforms Personalised Financial Advice

Final Thoughts: Can You Claim Financial Advice on Tax?

Claiming financial advice fees on tax in Australia can help reduce your tax liability if you follow the ATO rules. The key is ensuring the advice is income-related, keeping proper documentation, and understanding apportionment. Using examples and calculations, you can see exactly how much tax you save by claiming these fees.

Always consult a qualified tax professional to ensure your deductions are compliant with current ATO regulations. Proper planning can make a real difference to your tax efficiency and overall financial health.