Retirement might seem far away, but the earlier you start planning, the bigger the impact on your financial future. Superannuation, or “super,” is a powerful way to build a retirement fund. By strategically making contributions, choosing the right fund, and taking advantage of tax incentives, you can significantly increase your retirement savings. This blog provides detailed strategies, examples, and calculations to help you understand maximising your superannuation strategies to boost your retirement savings.

Understanding Superannuation

Superannuation is a government-mandated long-term savings plan designed to provide income during retirement. It typically consists of contributions from your employer, yourself, and sometimes the government. Funds are invested in various options, such as shares, property, or fixed interest, to grow over time. You can usually access your super after reaching a certain age or meeting specific conditions.

Key factors affecting super growth:

- Contributions: Regular contributions by you or your employer.

- Investment returns: Growth depends on your fund’s investment performance.

- Fees and taxes: Reducing fees and taxes maximises your final balance.

- Time: The longer the money stays invested, the more it benefits from compounding.

Maximising Your Superannuation Strategies to Boost Your Retirement Savings

Here are proven strategies to grow your super efficiently:

1. Make Voluntary Contributions

Voluntary contributions are extra payments made to your super beyond employer contributions.

- Pre-tax (concessional) contributions: Reduce taxable income, grow tax-effectively.

- After-tax (non-concessional) contributions: Eligible for government co-contributions or tax incentives.

Example:

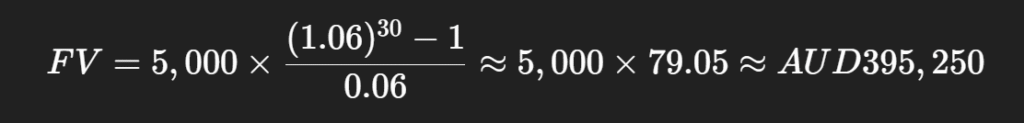

If you contribute AUD 5,000 per year voluntarily for 30 years with a 6% annual return, the future value is:

Even small contributions early can make a huge difference.

2. Use Salary Sacrifice

Salary sacrificing means redirecting part of your salary into super before tax.

Benefits:

- Reduces your taxable income.

- Boosts retirement savings via compounding.

Example:

- Annual salary: AUD 80,000

- Sacrificed amount: AUD 5,000

- Tax saving (if marginal tax 32.5%): 5,000 × 32.5% = AUD 1,625

- Money grows in super at 6% annual return over 30 years: ~AUD 395,250

This method both reduces tax and grows your super.

3. Take Advantage of Government Incentives

Governments often provide co-contributions or tax offsets to encourage super contributions.

Example:

- Low-income earner contributes AUD 1,000 after-tax

- Government adds AUD 500 as co-contribution

- Total contribution: AUD 1,500 grows in super at 6% per year

This “free money” can significantly boost retirement savings over time.

4. Choose the Right Super Fund

Fund choice matters. Consider:

- Fees: Lower fees = more growth. Even 1% difference can add tens of thousands over decades.

- Investment options: Match risk profile to age and retirement goals.

- Past performance: Consistent long-term returns matter more than short-term spikes.

Fee Impact Example:

| Fund | Net Return | Balance after 25 years on AUD 100,000 |

| Fund X (0.8% fee) | 6.2% | AUD 434,500 |

| Fund Y (1.5% fee) | 5.5% | AUD 371,100 |

Choosing a lower-fee fund can save over AUD 63,000.

5. Consider Your Risk Profile

Your investment risk tolerance affects returns:

- Younger investors (20s-40s): Can afford higher-risk, high-growth investments.

- Older investors (50+): Shift to conservative options to protect capital near retirement.

Regularly rebalance investments to maintain a suitable risk level.

6. Regular Review and Adjustments

Super isn’t “set and forget.” Monitor:

- Fund performance

- Fees and charges

- Contribution levels

- Investment mix

Adjust as your salary, life circumstances, and financial goals change.

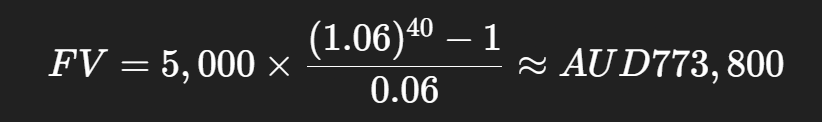

The Power of Compounding

Compounding allows your investment returns to generate additional returns. The earlier you start, the greater the effect.

Example:

- Age 25, voluntary contribution: AUD 5,000/year

- Annual return: 6%

- Retirement at 65 (40 years)

If starting at age 45 (20 years), future value: ~AUD 183,890. Early contributions grow almost 4 times more.

Calculated Case Study: Comparing Strategies

Scenario:

- Age: 35

- Salary: AUD 80,000

- Current super: AUD 50,000

- Employer contribution: 10% = AUD 8,000/year

- Retirement at 65 (30 years)

| Plan | Voluntary Contribution | Gov’t Co-contribution | Net Return | Final Balance |

| A | None | None | 6% | AUD 919,530 |

| B | AUD 5,000/year | None | 6% | AUD 1,314,765 |

| C | AUD 5,000/year | AUD 500/year | 6% | AUD 1,354,280 |

Adding voluntary contributions and government incentives can boost retirement savings by 43-47%.

Also Read: Retire Ideas Try After Retire: Smart, Fun, and Financially Secure Choices

Life Stage Adjustments

- Early career (20s-30s): Focus on high-growth investments, maximise contributions.

- Mid-career (40s-50s): Consider risk diversification, increase voluntary contributions if possible.

- Pre-retirement (55+): Reduce investment risk, preserve capital, focus on stable income streams.

Avoid Common Mistakes

- Thinking it’s too late: Even late contributions help.

- Ignoring fees: Higher fees erode growth over decades.

- Assuming high returns are guaranteed: Diversify, manage risk.

- Over-contributing: Exceeding caps leads to penalties.

- Neglecting reviews: Life changes require strategy adjustments.

Practical Tips for Maximising Super

- Start early and contribute regularly

- Use salary sacrifice for tax benefits

- Monitor and reduce fees

- Choose the right fund with good long-term performance

- Take advantage of government co-contributions or offsets

- Rebalance investments based on age and risk tolerance

- Review contributions annually and adjust as needed

Conclusion

Maximising your superannuation is not just about contributing more money—it’s about making smart, calculated choices. Combining voluntary contributions, salary sacrifice, government incentives, smart fund selection, risk management, and regular reviews can dramatically increase your retirement savings.

Compounding works best over time, so the earlier you start, the greater your advantage. By implementing these strategies, monitoring your super regularly, and adjusting based on life stage, you can build a robust retirement fund that ensures financial security and peace of mind.

Remember: Small, consistent actions today can create a significant impact on your financial freedom tomorrow.