Planning for retirement is one of the most important financial steps in life. In Australia, superannuation (super) is the main way to build retirement savings. While the government Age Pension provides support, relying on it alone often isn’t enough for a comfortable lifestyle.

This blog will give you detailed retirement savings superannuation advice, explain how much super you may need, outline strategies to grow your fund, and provide calculated examples so you can understand how small decisions today impact your financial freedom tomorrow.

What is Superannuation?

Superannuation is Australia’s retirement savings system where employers, and sometimes individuals, contribute money into a super fund. These contributions are invested, and the returns compound over decades, helping you build a nest egg.

- Employer contributions: Currently set at 11.5% of your salary (2024–25) and rising to 12% by 2025.

- Voluntary contributions: You can add extra via salary sacrifice or personal deposits.

- Tax advantages: Contributions and earnings in super are taxed at concessional rates, helping your money grow faster than if invested outside super.

Super is preserved until you reach your preservation age (between 60–67, depending on your birth year) or meet special conditions like retirement.

How Much Super Do You Need for Retirement?

The Association of Superannuation Funds of Australia (ASFA) provides a Retirement Standard that estimates how much money singles and couples need for either a “modest” or “comfortable” retirement.

ASFA Retirement Standard (as of 2024)

- Single person: About $50,000 per year for a comfortable lifestyle.

- Couple: About $70,000 per year for a comfortable lifestyle.

This assumes retirees own their home outright and live until their mid-80s.

Lump Sum Estimates at Retirement Age (67)

- Single: ~$595,000

- Couple: ~$690,000

If you only want a modest lifestyle, you may need significantly less because the Age Pension will cover more of your basic expenses.

Super Balance by Age: Benchmarks

According to the Australian Retirement Trust, here’s what you should ideally have saved in your super at different ages:

| Age | Suggested Super Balance (Single) |

| 30 | $54,000 |

| 40 | $143,000 |

| 50 | $258,000 |

| 60 | $415,000 |

| 67 | $545,000+ |

These are just guideposts. If you’re behind, don’t panic — there are strategies to catch up.

Example: How Much Super Will You Have?

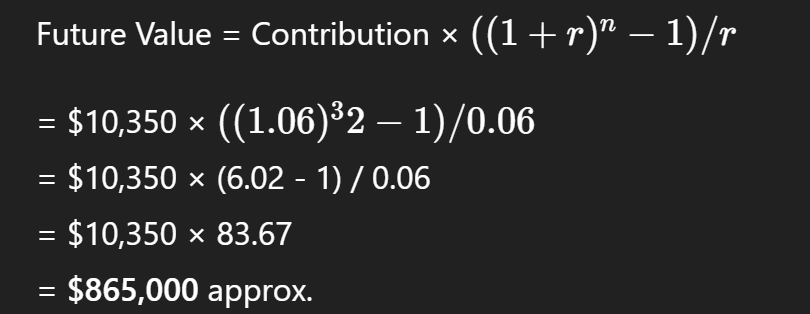

Let’s take a 35-year-old earning $90,000 annually.

- Employer contributions (11.5%): $10,350/year

- Assume super earns an average return of 6% per year

- Time to retirement: 32 years

This shows that even without voluntary contributions, this worker could reach close to the benchmark for a comfortable retirement.

Retirement Savings Superannuation Advice: Strategies to Boost Your Super

1. Salary Sacrifice (Before-Tax Contributions)

Adding even a small extra amount from your pre-tax salary can have a big impact.

Example:

If our 35-year-old worker contributes an extra $100 per month ($1,200/year):

FV = $1,200 × ((1.06)32−1)/0.06((1.06)^32 – 1)/0.06((1.06)32−1)/0.06

= $1,200 × 83.67

= $100,400 extra by retirement.

That’s a six-figure boost from just $25 a week.

2. After-Tax Contributions (Non-Concessional)

If you have spare savings, you can deposit extra into super (up to annual caps). This doesn’t reduce taxable income but grows in a low-tax environment.

3. Government Co-Contribution

If your income is below ~$58,000, the government may match your after-tax contributions up to $500 annually. This is free money.

4. Consolidate Super Accounts

Multiple accounts mean multiple fees and insurance premiums. Rolling everything into one account saves money and makes growth more efficient.

5. Choose the Right Investment Option

Super funds offer options like:

- Growth (higher risk, higher return)

- Balanced (medium risk, steady growth)

- Conservative (lower risk, stable returns)

When young, a growth option may suit. Near retirement, shifting to balanced or conservative protects your capital.

6. Watch Fees and Insurance

High fees can erode thousands from your super balance over decades. Compare funds and check if insurance cover inside super is necessary.

Tax Benefits of Super

Contributions Tax

- Employer contributions and salary sacrifice: taxed at 15%, often lower than personal income tax rates.

- High income earners (>$250,000): extra 15% tax may apply.

Investment Earnings

- Earnings inside super are taxed at 15%.

- Capital gains tax can be reduced to 10% if the asset is held >12 months.

Retirement Phase

Once you retire and switch your super to a pension account, earnings become tax-free (up to the transfer balance cap of $1.9 million).

Withdrawals and Rules

- You generally can’t access super until reaching preservation age (60–67).

- At retirement, you can:

- Take a lump sum

- Start an account-based pension (drawdowns)

- Mix both

- Take a lump sum

The government sets minimum withdrawal rates based on your age. For example, at age 65–74, you must withdraw at least 5% of your balance each year.

Example: Retirement Income from Super

Suppose you retire at 67 with $700,000 in super.

If you invest in an account-based pension earning 6% annually, and withdraw 5% yearly:

- Annual withdrawal = $35,000

- Investment earnings = $42,000

- Net effect: balance may still grow in early years, providing sustainable income.

Add the Age Pension (around $28,500/year for singles or $43,700 for couples), and your retirement income could comfortably exceed $70,000 per year.

Common Mistakes to Avoid

- Not tracking your super balance – Many Australians don’t know their super fund balance until it’s too late.

- Having multiple accounts – Wastes money on extra fees.

- Choosing the wrong investment option – Too conservative too early can cost growth; too risky near retirement can cause losses.

- Not reviewing insurance inside super – You may be paying for cover you don’t need.

- Relying only on Age Pension – Pension rules can change and may not cover all expenses.

Checklist for Australians Planning Retirement

✅ Know your current super balance

✅ Compare it with benchmarks for your age

✅ Estimate how much you’ll need at retirement

✅ Consider extra contributions (salary sacrifice, after-tax, co-contributions)

✅ Review investment options in your fund

✅ Minimise fees by consolidating accounts

✅ Monitor insurance policies inside super

✅ Stay updated on tax and contribution caps

✅ Review regularly and adjust as life changes

Also Check: 4 Mistakes That People With Poor Retirement Planning Make

Conclusion

Building retirement savings in Australia largely revolves around making the most of superannuation. By understanding how much you need, making regular contributions, choosing the right investment options, and taking advantage of tax benefits, you can create a strong foundation for your retirement.

The earlier you start planning, the more powerful compounding becomes. Even small extra contributions can translate into hundreds of thousands of dollars at retirement. Combine this with smart drawdown strategies and potential Age Pension support, and you’ll be well on your way to a secure and comfortable retirement.